Key takeaways

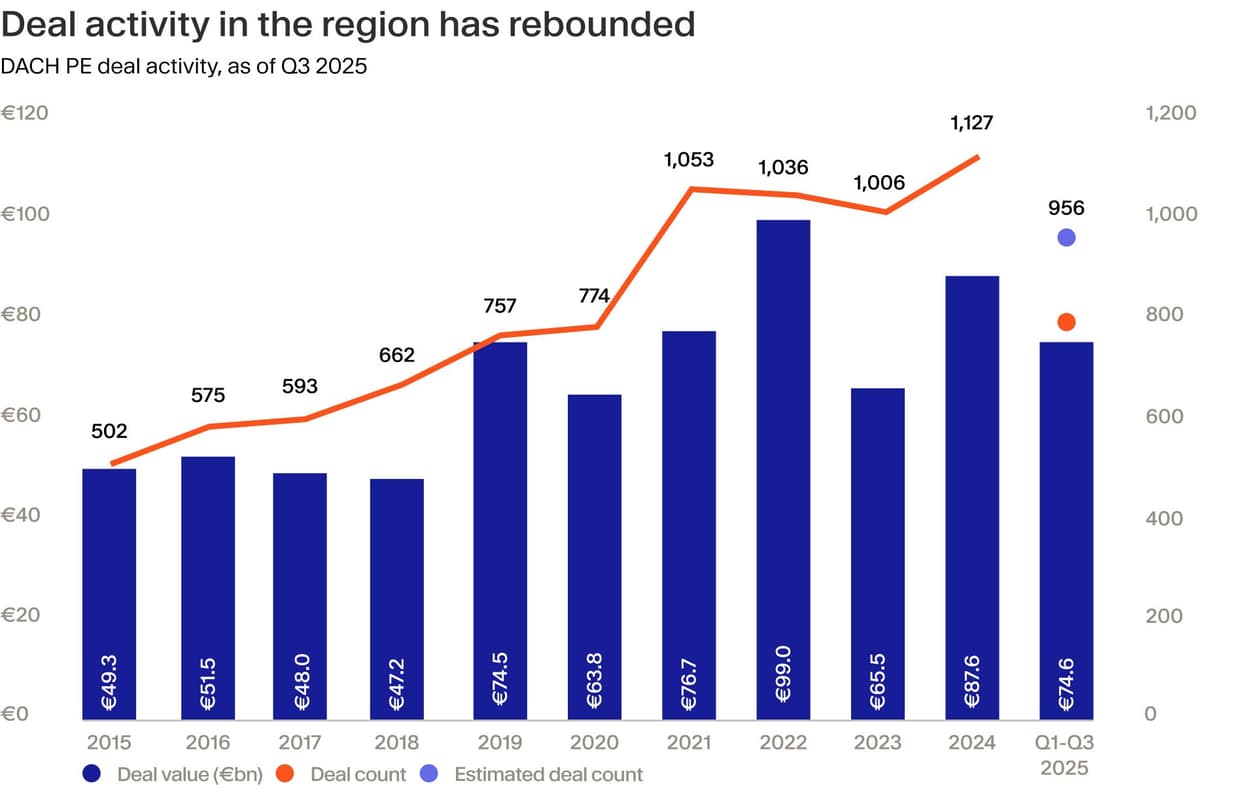

- Dealmaking in the region is tracking above record levels, with nearly €75 billion closed in the first three quarters of 2025.

- Global investors are increasingly looking to Europe to diversify US exposure, with Germany well positioned to benefit, says Philip Meschke, Head of Private Equity.

- Massive government spending may help the broader economy regain momentum, though de-industrialisation presents a challenge.

Germany’s private equity market appears to be entering a much more constructive period after two years of relatively muted activity. While dealmaking across Europe has remained uneven, Germany has grown its presence as the engine of DACH’s private market ecosystem, which also includes Switzerland, Austria and Liechtenstein. Europe's largest economy now accounts for 82.1% of regional deal value, up from 72.9% in 2023, according to data from Pitchbook.¹

Dealmakers in the region have had a particularly successful year. They’ve closed €74.6 billion in transactions over the first nine months of the year, putting them on track to match or exceed the record set in 2022.

This means the market is likely going to record a double-digit PE deal growth in 2025 compared to the year before. The third quarter alone saw a 71.5% quarter-over-quarter surge in value,² supported by improving financing conditions, easing inflation and a more cautious stance from the ECB.³⁴ Easing EU-US tariff tensions removed a headwind that had slowed cross-border activity earlier in the year.

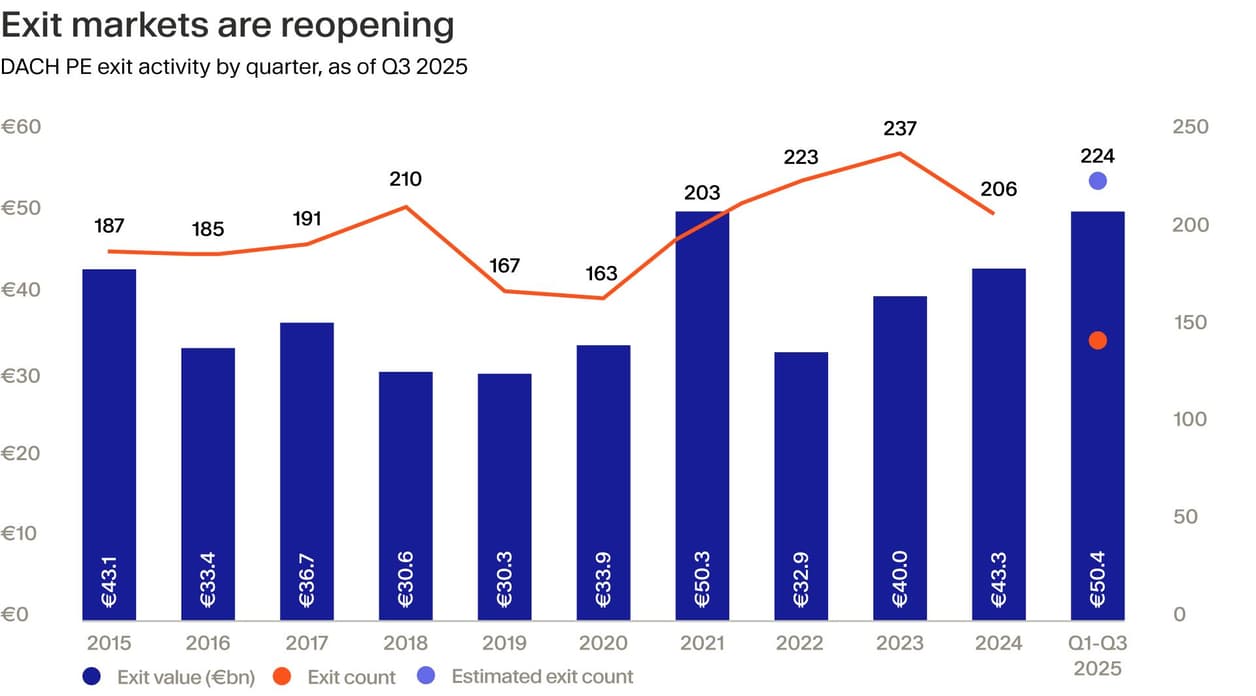

Liquidity conditions across DACH private equity markets are also improving, with €50.4 billion realised across 224 exits in the first three quarters of 2025. Activity remains concentrated in secondary and sponsor-to-sponsor transactions which now account for over half of total value, the highest share on record. In our view, this reflects cautious buyer behaviour amid still-selective public and strategic exit markets.⁵

Meanwhile, fundraising remains the weakest component of the private equity cycle in the region. Only €4.5 billion has been raised across eight PE funds year-to-date, well below the €22.7 billion raised in 2024. Germany represents the majority of this activity, yet volumes remain meaningfully below historical norms, underscoring continued LP caution despite improving market fundamentals.⁶

Focus on Europe

A renewed upswing in global investment activity is expected to support Europe and Germany in particular. “As uncertainty persists across global markets, investors are placing emphasis on diversification and are looking to Europe to balance US exposure,” says Philip Meschke, Moonfare’s Head of Private Equity. In his opinion, Germany is a likely beneficiary of this trend.

Pitchbook data confirms this shift: 70% of all DACH PE deals in 2025 involve at least one foreign investor, up from 60% in 2020, signalling fundamental structural change in the market.

Cross-border partnerships between local and global GPs are increasing as firms collaborate on larger deal sizes and sector-specialist strategies.⁷

Unlike previous economic expansions, individual investors and family offices now also have increased access to private markets. There has been a five-fold increase in the number of German speaking family offices in the last five years and, according to Preqin. Family offices in these countries have now become the largest investor group for private markets funding.⁸ These investors are set to play a major role in local and European markets.⁹

Thematic opportunities

Meanwhile, opportunity in the country is increasingly being shaped by policy priorities and technological change. Several sectors are attracting disproportionate levels of investor attention.

“Germany has seen a thematic tilt towards defense. There has been an increase in the number of defense companies and underlying contractors, as well as some large fundraising rounds for companies such as Helsing which is valued at €12 billion. This may provide a big opportunity for investors,” says Meschke.

An important theme is also automation and the digitisation of industries. Germany’s AI market is set to grow by 26% annually until 2031.¹⁰ “I’m sure this is a sector where we will see more PE activity,” Meschke believes. Across the DACH region, AI is the top VC vertical by deal value in 2025, attracting €2.7 billion year-to-date.¹¹

The energy transition is another potentially interesting opportunity for investors. As part of Germany’s recently-announced €500 billion infrastructure and climate neutrality fund, €100 billion will be dedicated to the climate and transformation fund (KTF) for investments into renewables, hydrogen and grid upgrades.

More than half of investors (53%) expect more private capital transactions in this sector in the near future, according to a recent PwC report.¹² In the DACH PE market, energy is pacing for a record year, with 25% of the top 20 deals in 2025 linked to energy or energy-transition assets.

Sunnier days ahead?

That said, the outlook is still shaped by long-standing structural challenges that define where private equity can add the most value. According to Meschke, these pressures are particularly evident across Germany’s industrial base. “The country has faced large-scale de-industrialisation following major competition and outsourcing from China.”

Germany is also facing a succession crisis. This issue is especially acute among Germany’s SME backbone. Of the roughly 626,000 small and medium-sized enterprises expected to undergo ownership transitions by 2027, only 26% have identified a successor. This has created both a structural risk for the economy and a compelling opportunity set for private capital.¹³

Encouragingly, cyclical conditions are beginning to improve. Germany’s GDP has rebounded following government spending on infrastructure and defense. GDP is now expected to grow by 1.4% in 2026 and 1.8% in 2027, outperforming post-Covid estimates.¹⁴ The sunnier outlook is helped by four ECB rate cuts, easing inflation and stabilising credit markets.¹⁵

If current trends continue, we believe that the coming years may offer a strategically favourable window for investors looking to re-enter or deepen their exposure to the German private markets.

⁴https://www.ft.com/content/f4b36069-d44c-4ff6-8584-1ce29e9a730a

⁸https://www.boersen-zeitung.de/english/family-offices-private-markets

⁹https://www.boersen-zeitung.de/english/family-offices-private-markets

¹³https://www.kfw.de/About-KfW/Newsroom/Latest-News/Pressemitteilungen-Details_795968.html

¹⁴https://www.goldmansachs.com/insights/articles/germanys-economy-is-forecast-to-outperform-in-2026