Key takeaways

- Private credit’s cash-flow profile makes the asset class compatible with evergreen funds structures.

- Evergreen vehicles change how private credit is accessed, but not the risks involved, requiring investors to understand liquidity constraints, valuation mechanics and portfolio construction.

- Recent high-profile failures such as First Brands do not define private credit, but they do underline why transparency and oversight matter.

- As dispersion between borrowers increases, manager selection and underwriting quality are becoming more important.

Investors today continue to wrestle with a familiar tension. Public credit markets offer liquidity, but yield spreads remain tight¹ while diversification benefits have been less reliable in recent years, particularly in government and long-duration investment-grade bonds during inflation-driven market stress.² That has made the incremental income and diversification benefits that investors seek harder to achieve.

This tension is driving growing interest in private market solutions that can deliver return potential while offering more flexible liquidity profiles.

Evergreen vehicles — open-ended structures offering periodic redemptions — and the rapid expansion of private credit have become a natural answer to this demand. While their success and growth have been independent from one another, when combined they may potentially offer something that many investors want: income, diversification and access, packaged in an investor-friendly format.

Private credit performance

Once a relatively niche strategy, credit has become one of the largest and most important areas of private markets. It covers a broad spectrum, from senior secured and unitranche loans to asset-based finance and speciality credit, but at its core is the provision of directly originated loans to private companies.

The asset class’s appeal is rooted in predictable contractual income, floating-rate coupons that adjust with interest-rate conditions and senior, typically secured, positions that can offer greater control and flexibility than broadly syndicated public credit.

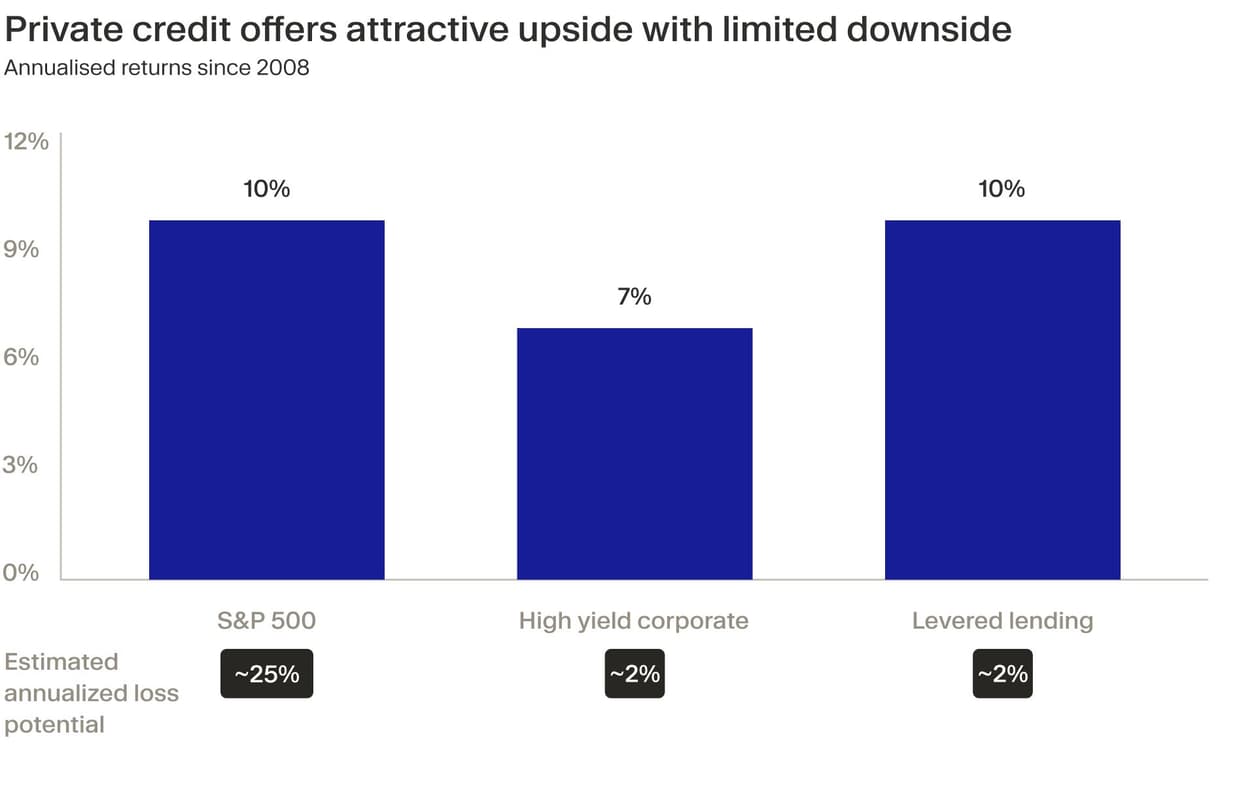

Long-term data from Hamilton Lane show that private credit has delivered positive vintage-year IRRs in every year for more than two decades,³ making it one of the most consistent performers in private markets. Over time, it has compared favourably with public credit, with similar or lower loss severity and more modest drawdowns across cycles. Specifically, the asset class has delivered returns of 10% per year since 2008 versus 7% for high-yield corporate debt, with an annualised loss potential of only 2%.

This superior risk-adjusted return profile has resulted in explosive growth. Apollo Global Management estimates an approximate tripling in private credit assets under management (AUM) to $3 trillion over the past decade.⁴

The rise of evergreen funds

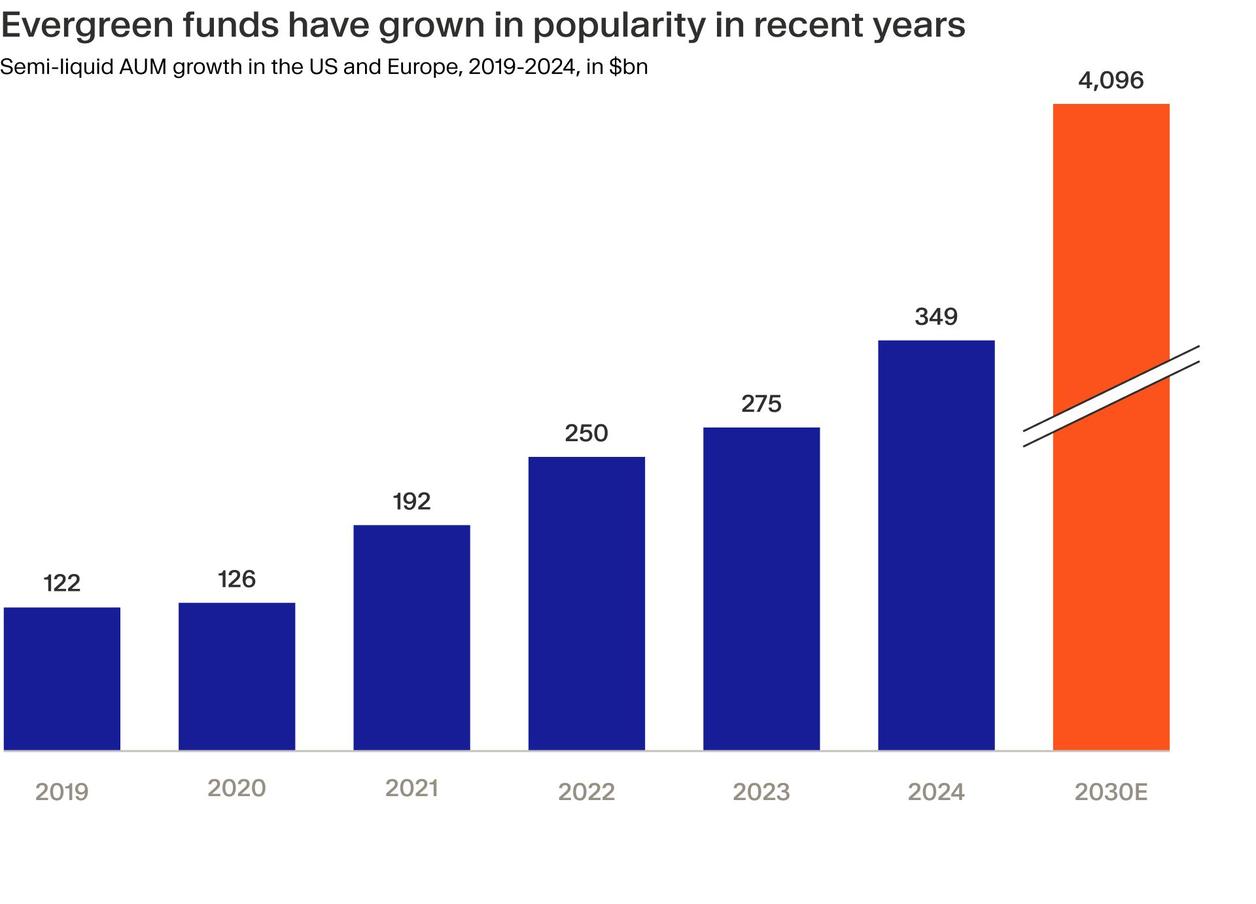

Evergreen funds have undergone a similarly impressive rise. While not a new phenomenon, these funds are surging in popularity as a way to meet the needs of investors, who value access but are less tolerant of the decade-long lock-ups institutional investors are accustomed to. By allowing continuous subscriptions and offering liquidity at defined intervals, typically monthly or quarterly, evergreen structure has found clear product market fit, in particular for investors new to the asset class or those seeking to complement a portfolio of closed-ended funds.

Deloitte estimates that evergreen AUM climbed from roughly $126 billion in 2020 to $349 billion in 2024 and could exceed $4.1 trillion by 2030.⁵ PitchBook and Morningstar data show similar momentum, with the US evergreen universe now above $450 billion and on course to surpass $1 trillion within a few years.⁶

It needs to be noted, however, that liquidity is offered within defined limits, not on demand. If redemption requests exceed those limits, investors may receive only a portion of their requested capital, with the remainder deferred.

A structural fit

Evergreen vehicles function best when the underlying assets naturally generate cash. Private credit offers exactly that. Recurring interest payments, often quarterly, can help support redemption flows without requiring managers to sell assets. Principal repayments add an additional source of liquidity, enabling managers to redeploy capital or meet investor requests. This can make private credit a more compatible match for evergreens than private equity, where cash flows are uncertain and led by sporadic liquidity events.

For an evergreen fund, this creates a natural portfolio rhythm: repayments, repricing and reinvestment occur continuously. Even relative to evergreen private equity strategies, portfolio construction is smoother, as capital is recycled through contractual cash flows rather than relying primarily on episodic exits.

Valuation characteristics add another benefit. Because private credit is valued periodically rather than traded daily, reported valuations tend to be less sensitive to short-term market sentiment and fluctuations. While this does not alter underlying credit risk and can lag in fast sell-offs, it can help evergreen vehicles manage liquidity without being forced into pro-cyclical asset sales.

Nor is private credit a single-line exposure. Managers can blend senior secured lending, sponsor-backed unitranche, asset-based finance and selective opportunistic strategies within a single portfolio. This internal diversification strengthens evergreen structures by spreading risk across industries, borrowers and credit types.

Weighing the risks

Investors understand that there’s no such thing as a free lunch. Although historic loss rates in private credit are low, they are not zero. Credit losses and defaults inevitably occur over time as the credit cycle matures and underwriting assumptions are tested. Since NAV estimates in private portfolios are made periodically, those stresses may not be immediately visible, but they eventually surface through restructurings, impairments and realised losses. Apparent stability early in a loan’s life should not be confused with the absence of credit risk.

Documentation quality is another important consideration. Competitive dynamics have pushed parts of the private credit market toward covenant-lite structures. This may reduce lenders’ early-warning triggers and, in some cases, weaken recoveries in downturns.

In recent years, however, documentation terms in larger private credit transactions have increasingly converged with those in the broadly syndicated loan market. As lenders compete for deal flow, covenant-lite structures — which lack recurring financial maintenance tests — have become more common.⁷ This trend has been less evident in middle-market direct lending and sponsor-less transactions, where documentation quality has remained relatively more consistent.

Maintenance covenants play a key role in signalling borrower distress and preserving recovery options, so their erosion can reduce lenders’ ability to act early when performance worsens.

The practical implication of this is performance increasingly depends on where and how credit risk is taken. It’s therefore essential to distinguish between managers with robust underwriting skills and those that rely more heavily on benign economic conditions for their loss performance.

Sector concentration can also influence losses and returns. Certain pockets of the market, such as technology or cyclical industries, may show correlated stress when conditions deteriorate. For instance, Apollo, one of the largest private credit investors globally, reduced software sector exposure within its private credit funds in 2025 amid risk concerns and even placed tactical bets against specific software loans during the year.⁸ This behaviour reinforces the importance of diversification within portfolios rather than treating private credit as a single, homogeneous allocation.

High-profile failures don’t define private credit

Recent negative headlines have intensified scrutiny of private credit and that attention is appropriate. High-profile failures such as Tricolor Holdings and First Brands have featured prominently in public debate, but they also highlight the importance of distinguishing between different parts of the market.

Tricolor operated in sub-prime auto lending, at the furthest end of the risk curve, while First Brands relied on more complex, non-standard forms of non-bank credit rather than the sponsor-backed senior secured lending that dominates institutional private credit portfolios.⁹ These cases do not define private credit as a whole, but they do underline why transparency, oversight and a clear understanding of risk exposure matter.

Borrower dispersion and manager selection

Many are expecting greater oversight of the private credit industry.¹⁰ Moonfare welcomes robust regulation, strong investor protection and greater transparency across private markets. As private credit becomes more widely accessed through evergreen structures, these safeguards can help ensure that risk is properly understood and that structurally sound strategies are differentiated from more fragile ones.

As elsewhere in private markets, manager selection is what matters most. Differences in underwriting discipline, documentation standards, sector exposure and portfolio construction can lead to different outcomes over time. In evergreen vehicles, this discipline extends to ongoing portfolio and liquidity management alongside the fundamentals of credit selection.

The easy beta of the last cycle is fading. While credit spreads remain tight, higher finance costs of the past three years increased borrowers’ debt service burdens, straining weaker balance sheets. Refinancing is no longer frictionless and dispersion between borrowers is widening.¹¹ Underwriting precision and active risk management matter more now than ever before.

¹ https://fred.stlouisfed.org/series/BAMLH0A0HYM2

² https://www.morningstar.com/portfolios/what-higher-inflation-means-stock-bond-correlations/

³ https://www.hamiltonlane.com/en-us/insight/2025-mid-year-outlook

⁵ https://www.deloitte.com/us/en/insights/industry/financial-services/semi-liquid-funds.html

⁷ https://practiceguides.chambers.com/practice-guides/private-credit-2025/uk/trends-and-developments

¹⁰ https://www.ocorian.com/knowledge-hub/insights/regulators-are-expected-toughen-private-credit

¹¹ https://www.carlyle.com/global-insights/research/2026-credit-outlook