Key takeaways:

- AI's momentum, fuelled by expanding capabilities and plummeting operational costs, is making the technology increasingly viable.

- Corporate spending on AI is ramping up. Budgets are shifting decisively toward growth and innovation across sectors.

- Despite broader market uncertainty and volatility, VC investment into AI companies remains resilient. Startups in this space attracting a substantial share of venture dollars.

Artificial intelligence (AI) seems to have finally made its grand entry. In short order the technology has begun to reshape industries in a very real way, with businesses now rewiring their operations to squeeze value out of increasingly capable models.

The percentage of organizations using AI in at least one business function jumped from 55% in 2023 to 78% in 2024, according to Stanford University. The adoption of generative AI (GenAI) specifically, has surged even more forcefully, rising from 33% to 71% in the same period.¹

There’s hardly any business function that doesn’t benefit from AI adoption in some way. Nascent trends show that IT departments are the early adopters² as usage also spreads across service operations, product development, software engineering and knowledge management.

Companies are applying AI where it can generate significant value – from improving customer service in telecom to optimizing drug discovery in healthcare and improving design processes in advanced industries.

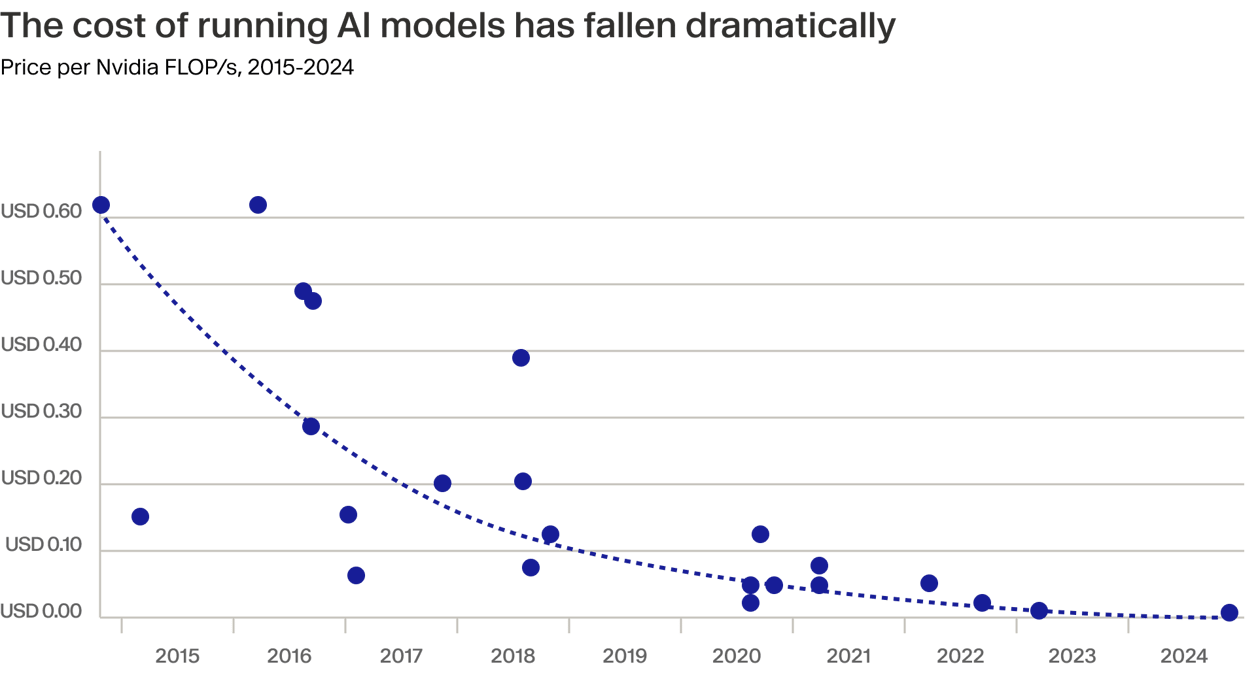

Plummeting costs

While the cost of training large, frontier AI models remains high, the cost associated with using these models (inference) has seen vast declines due to improvements in specialized hardware like the high-performance graphics processing units (GPUs). This is making AI more accessible and economically viable for a wide range of tasks.

For example, the price per floating-point operation per second (FLOP/s) – a measure of computational power per dollar – on industry-standard Nvidia GPUs fell by over 75% between 2022 and 2024.³ Similarly, Stanford estimates that the cost to run a model performing at OpenAI’s GPT-3.5 level dropped over 280-fold between November 2022 and October 2024 alone.⁴

In other words, the same budget now buys significantly more computational power, making the technology commercially viable.

Economic and business impact

For now it’s still early to measure the direct impact of the ongoing AI transformation on the real economy, though it won’t be long. Goldman Sachs research suggests that significant boosts to US productivity could start showing in GDP figures as early as 2027.⁵

Sensing the opportunity, companies are leaning heavily into AI. IT budgets are shifting decisively toward growth and innovation, with one in three companies globally planning to invest more than $25 million in AI in 2025.⁶

Some sectors are especially bullish: retailers expect a 52% jump in AI spending beyond the bounds of traditional IT,⁷ while 82% of manufacturers say they’ll boost their AI budgets over the next 12-18 months – often to roll out AI-ready enterprise resource planning (ERP) systems.⁸

Despite broad adoption and increasing budget allocations, the enterprise-level bottom line hasn’t shifted dramatically just yet: more than 80% of companies still report limited EBIT impact from GenAI, according to McKinsey.⁹ But the gears are already starting to turn and the top lines are feeling the benefit. Compared with early 2024, a significantly larger share of companies now report revenue gains within the business units deploying GenAI. For example, the share of companies seeing revenue increases in supply chain and inventory management rose from 53% to 67% between H1 and H2 2024, while marketing and sales saw a rise from 53% to 66%. Meanwhile, more than half of organizations are also reporting tangible cost reductions across functions as their AI deployments mature.¹⁰

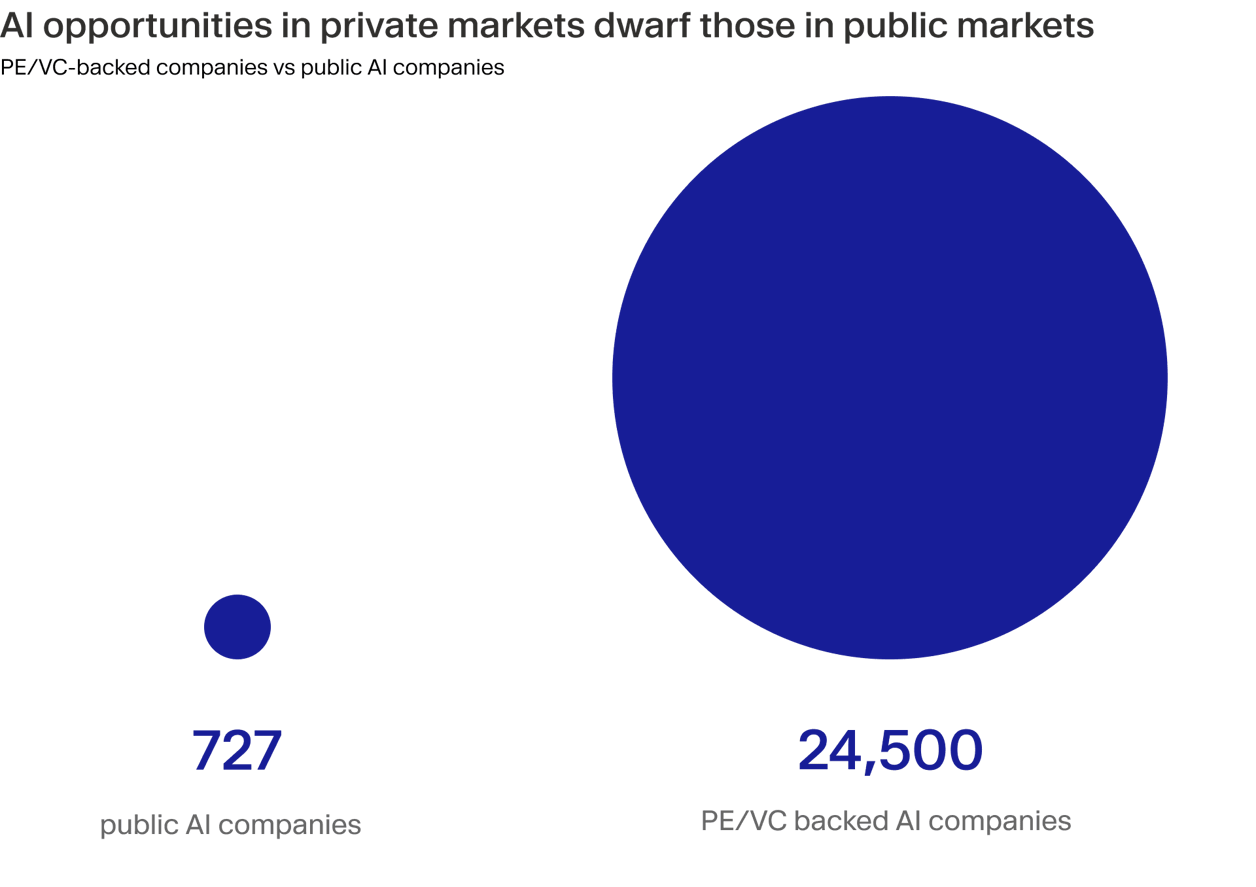

Opportunities in private markets

So, how exactly can investors actually gain exposure to this growth wave? In public markets, we believe there are limited options. By our estimate, based on Pitchbook data, there were 727 AI-related stocks to choose from globally as of mid-2024. Now compare that to private markets, where there are some 24,500 such companies backed by funds – a 33x differential.¹¹

Our view is that accessing private markets, and early-stage venture capital in particular, likely presents one of great opportunities to board the AI train before it leaves the station. VC and PE funds are uniquely positioned to identify, nurture and scale startups developing groundbreaking AI technologies and applications into the giants of tomorrow.

Big investment bets on AI

To say that VCs funds are already zeroing in on AI is an understatement. Global funding into the space reached extraordinary levels early this year. While figures vary depending on methodology, various reports show that AI is capturing a staggering share of early-stage capital. KPMG estimates that of the $126.3 billion in global venture capital deployed during Q1, $52 billion, or 41%, went to AI startups, albeit this was heavily skewed by OpenAI's $40 billion round.¹² PitchBook places the Q1 figure even higher at $73.1 billion, accounting for nearly 58% of global VC dollars invested.¹³ On a deal-for-deal basis, meanwhile, CB Insights notes that AI now accounts for 1 in 5 global venture funding rounds.¹⁴ This intense investment activity is highly concentrated. North America, particularly the US, dominates, attracting roughly 70% of AI deal value in the first quarter of this year.¹⁵ Mega rounds, those valued at $100 million or more, are also becoming more common, even at early stages, with eight such deals in Q1.¹⁶

AI startups in action

Notable recent deals span diverse applications. In life sciences, the UK-based, Google-backed Isomorphic Labs secured $600 million in March – a significant first external round that saw Thrive Capital and GV come onboard to help reform drug discovery.¹⁷ Pushing the boundaries of physical automation, US humanoid robotics startup Apptronik raised $403 million in February from B Capital, Capital Factory and Google to deploy AI-powered bots in sectors like logistics and manufacturing.¹⁸ A smaller but still sizeable $180 million was secured by voice AI specialist ElevenLabs in January, a round that was co-led by a16z and ICONIQ Growth. The investment followed impressive commercial traction, with the company reportedly achieving $100 million in annual recurring revenue (ARR) just three years after its founding.¹⁹ ElevenLabs is not alone in scaling at pace. Data from payments processor Stripe indicate that the median time for AI startups to reach $5 million annualized revenue is 24 months. This contrasts with the 37 months it took Software-as-a-Service (SaaS) startups to reach this milestone in 2018. Put another way, AI startups are growing early revenues at a 35% faster rate than their SaaS counterparts before them.²⁰

Balancing risk and reward

Despite the palpable excitement in this emergent area of the economy, investing in AI via VC is not without risk. First, venture capital investing by its very nature is speculative. Investors rely on a small number of successful "home run" investments to generate overall fund performance.

Second, pockets of hype exist in AI. Identifying genuinely innovative products and business models, and understanding the potential economic value of startups, requires expertise, such as those of seasoned fund managers with demonstrable track records. But despite these valid concerns, the prevailing sense is that AI represents a durable, secular trend with truly transformative potential. The efficiency and competitive advantage gains are already being realised by businesses and, recognising this, many investors are actively seeking exposure to what many see as a generational opportunity. And by and large, private capital is responsible for funding much of AI’s future.

¹ https://hai.stanford.edu/ai-index/2025-ai-index-report ² https://www.mckinsey.com/~/media/mckinsey/business%20functions/quantumblack/our%20insights/the%20state%20of%20ai/2025/the-state-of-ai-how-organizations-are-rewiring-to-capture-value_final.pdf ³ https://www.robeco.com/files/docm/docu-20250408-tracking-ai-in-10-charts.pdf ⁴ https://hai.stanford.edu/ai-index/2025-ai-index-report ⁵ https://www.goldmansachs.com/insights/articles/AI-is-showing-very-positive-signs-of-boosting-gdp ⁶ https://www.bcg.com/press/15january2025-ai-optimism-autonomous-agents ⁷ https://www.rfidjournal.com/news/ibm-ai-spending-expected-to-surge-52-percent-as-retail-embrace-enterprise-wide-innovation/222770/ ⁸ https://erp.today/82-manufacturers-increasing-budgets-in-2025-to-grow-ai-ready-erp-rootstock/ ⁹ https://www.mckinsey.com/~/media/mckinsey/business%20functions/quantumblack/our%20insights/the%20state%20of%20ai/2025/the-state-of-ai-how-organizations-are-rewiring-to-capture-value_final.pdf ¹⁰ https://www.mckinsey.com/~/media/mckinsey/business%20functions/quantumblack/our%20insights/the%20state%20of%20ai/2025/the-state-of-ai-how-organizations-are-rewiring-to-capture-value_final.pdf ¹¹ Pitchbook 2024 ¹² https://kpmg.com/xx/en/media/press-releases/2025/04/global-vc-investment-rises-in-q1-25.html ¹³ https://pitchbook.com/news/articles/ai-startups-57-9-percent-global-venture-dollars-fear-of-missing-out-drives-up-dealmaking-q1-2025 ¹⁴ https://www.cbinsights.com/research/report/venture-trends-q1-2025/ ¹⁵ https://pitchbook.com/news/articles/ai-startups-57-9-percent-global-venture-dollars-fear-of-missing-out-drives-up-dealmaking-q1-2025 ¹⁶ https://www.cbinsights.com/research/report/venture-trends-q1-2025/ ¹⁷ https://www.isomorphiclabs.com/articles/isomorphic-labs-announces-600m-external-investment-round ¹⁸ https://apptronik.com/news-collection/apptronik-raises-350-million-in-series-a-funding ¹⁹ https://elevenlabs.io/blog/series-c ²⁰ https://www.robeco.com/files/docm/docu-20250408-tracking-ai-in-10-charts.pdf