In numbers

More 2025 insights

Five macro themes that will shape 2025

With the election year largely behind us, the focus now shifts to fiscal challenges, resolving the ongoing conflicts, looming trade tensions and China’s slowdown.

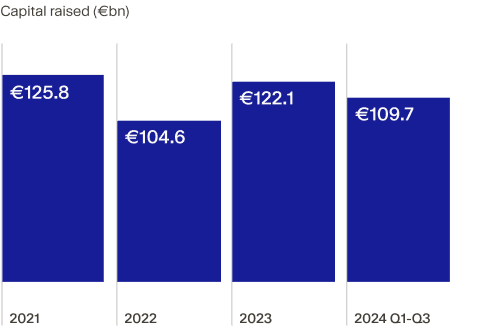

The case for PE as interest rates fall

Central banks are shifting toward looser monetary policies, which is expected to positively impact private equity dealmaking and portfolio management.³ ⁴

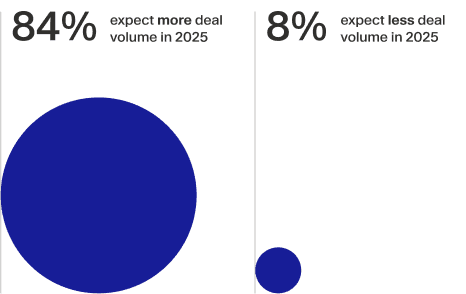

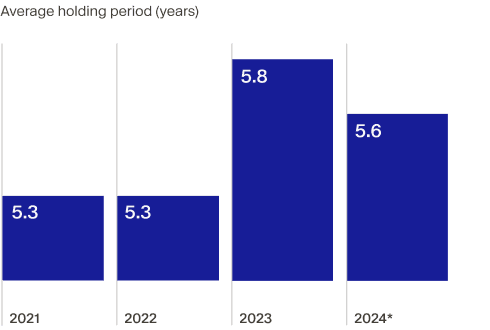

The exit outlook is the brightest in years

With deal markets showing signs of thawing, one question is on everybody’s lips: when will exit markets kick back into gear? The signs suggest the stage is being set for a recovery.⁵ ⁶ ⁷

PE is consolidating: the good and the bad

Large GPs are acquiring smaller firms to build scale and diversify, creating a more concentrated market with mixed implications for investors.⁸

Why are investors hungry for co-investments

Co-investments have long been a staple of the PE investing toolkit. The strategy has recently gained new attention from both institutional investors and fund managers.⁹ ¹⁰

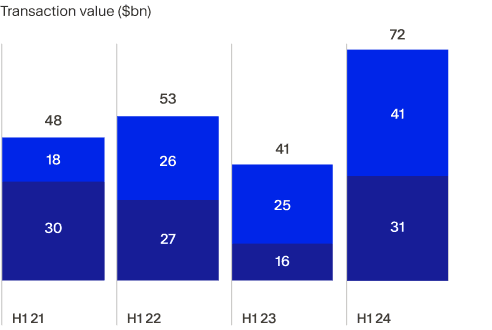

Why PE take-privates are taking off

Buyout houses are eyeing public-to-private deals as stock markets remain volatile and the private company valuations gap is limiting dealmaking to get into full swing.¹¹ ¹²