Edition 40

The Satellite

Dear Valued Member of the Moonfare Network,

Welcome back to the first edition of The Satellite in 2025! We hope your year is off to a great start.

Secondaries dealmakers certainly have plenty to be optimistic about if last year’s performance is any guide.

It was a record-breaking 12 months, with transaction volume surpassing $152 billion — nearly 40% higher than the previous year, according to Lazard.¹

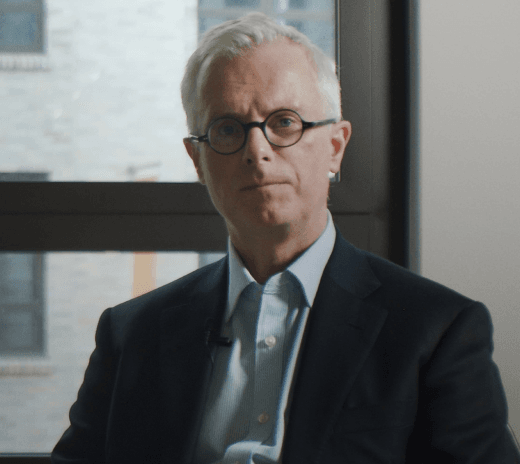

So, what’s next for secondaries in terms of pricing, asset quality and returns? We spoke with Philip Meschke, Moonfare’s Head of Investments, to get the answers.

Meanwhile, President Trump’s second term is off to a busy start, with a wave of executive orders — some of which might reshape the world trading system.

What could Trump’s agenda mean for private assets? Mike O’Sullivan breaks down the potential implications.

Happy reading!

Your Moonfare team

To view our selection of private equity strategies by top-tier managers, log on to the Moonfare platform.

If you don’t have an account yet, sign up and view our exclusive opportunities.*

Interview

Secondaries in private equity remain undercapitalised

There’s plenty of room for secondaries to grow beyond their current 1.2% share of the private markets, says Philip Meschke, Moonfare’s Head of Investments.

Company update

Moonfare invests in a leading producer of water pump systems

*Subject to eligibility. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.