Edition 37

The Satellite

Dear Valued Member of the Moonfare Network,

We recently asked our LinkedIn community whether the upcoming US election is prompting a shift in their investment strategy.

About 60% said they’re staying the course, while the rest largely prefer to hold off and wait for the outcome.

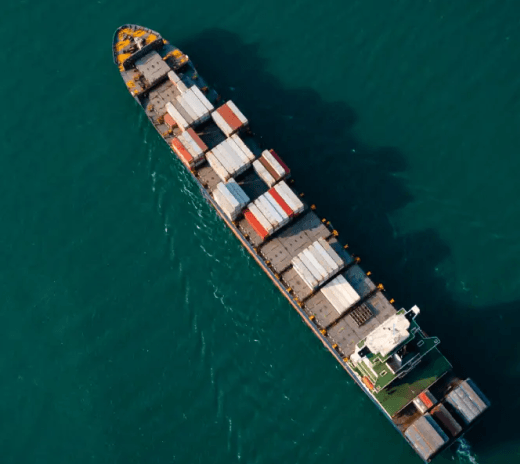

The election's impact on markets might indeed remain limited, yet it could in many ways disrupt global trade.

“A potential trade confrontation between the US and China would decisively shatter the axis of globalisation as we know it,” writes Mike O’Sullivan, Moonfare’s Chief Economist, in his report.

Meanwhile, private equity appears to have found firmer footing in 2024. Our year-to-date review shows strong fundraising and a revival in dealmaking, though exit activity has been less steady.

One of the more robust segments has been take-privates. As public market investors focus on large tech stocks, PE firms are capitalising on undervalued listed companies. Find out more in our latest article.

Happy reading! Your Moonfare team

To view our selection of private equity strategies by top-tier managers, log on to the Moonfare platform.

If you don’t have an account yet, sign up and view our exclusive opportunities.*

Insights

Why are take-privates taking off

This year is shaping up to be one of the strongest on record for PE-backed take-privates, surpassed only by the highs of 2021 and 2022.

Why are many buyout firms looking to unloved listed companies for deal flow?

Deal Talk

Join Moonfare’s Deal Talk with recently-appointed Permira’s co-CEOs

*Subject to eligibility. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.