Edition 16

The Satellite

Dear Valued Member of the Moonfare Network,

Welcome to our first edition of The Satellite for 2023. We hope you had a pleasant and peaceful holiday break.

If investors had any New Year's resolutions, surely one would have been to put the past 12 months behind them. Assets across the spectrum, from equity and credit to sovereign debt, felt the pinch as market conditions tightened. Many are now focusing on what they can do in 2023 to bolster their portfolios in uncertain times.

With this in mind, our expert investment team put together their expectations and predictions for private markets in the year ahead. You can read the report below.

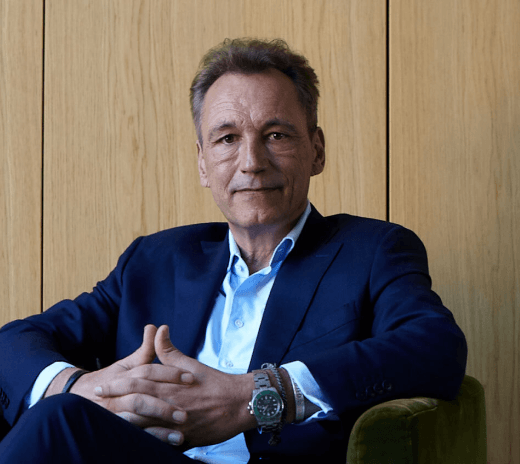

We also have exciting webinar news to share with you. You’re invited to join us for an exclusive interview with KKR Co-Founder, Henry Kravis. The legendary investor will discuss his career and the democratisation of private equity with our Founder and CEO, Dr Steffen Pauls. You can register to attend further on in this newsletter. We look forward to seeing you there.

Insights

Private markets in 2023: Moonfare's top 10 predictions.

Higher rates will change the game. Secondaries are going to come to the fore. And increasingly, operational expertise will become vital.

These are just some of the 10 key factors that our investment team believe could shape private markets in 2023. Uncover the rest below.

Join Moonfare's exclusive interview with KKR Co-Founder Henry Kravis.

Sign up now for our Deal Talk with the legendary investor Henry Kravis, taking place on Tuesday, 25th April (10am EST/4pm CEST).

Insights

Looking back at the stories that defined private equity in 2022.

Check out our selection of private equity strategies by top-tier managers on the Moonfare platform. Not a member? Sign up and view our exclusive opportunities.