Modified internal rate of return (MIRR)

Key Takeaways

- MIRR adjusts the traditional IRR calculation to accommodate financing costs and reinvestment rates for distributions.

- MIRR is more sensitive to the timing of single cash flows than a traditional IRR.

What is Modified Internal Rate of Return (MIRR)?

Modified Internal Rate of Return (MIRR) is a method of calculating the return on an investment with multiple, irregular cash flows. MIRR produces a blended overall investment return that accommodates a specified cost of capital for inflows and a specified reinvestment rate for outflows, both of which can be different from the returns generated by capital inside the investment.

MIRR differs from a traditional Internal Rate of Return (IRR) calculation in that IRR calculates a single discount rate that is assumed to represent the financing rate for cash inflows, the rate of growth on the investments made, and the reinvestment rate for cash distributions emanating from the investment.

The MIRR provides a more practical and realistic assessment of the time value of cash flows in that it recognizes a different rate of return on cash awaiting investment and cash distributed by the investment from the return generated while in the investment. MIRR adjusts the overall IRR of the project or investment to accommodate these other rates.

For investments that have a single cash flow in and single distribution out, MIRR will essentially be the same as the IRR. With private equity funds, however, cash flows in and out typically occur over multiple years. In that case, MIRR will provide a more realistic total return that considers the actual financing cost of cash inflows and the reinvestment rate for distributions coming out of the fund.

MIRR in private equity: Why is it relevant?

IRR and MIRR are methodologies for calculating investment performance that consider the time value of irregular cash flows in and out of the investment. Both enable multiple cash flows to be condensed into a single performance number that equates to making an initial investment all at once and receiving a single distribution all at once at a future date. This makes them directly applicable to private equity funds where capital calls to investors and subsequent distributions are spread out over the life of the fund.

IRR and MIRR calculations thus provide investors and managers with a way to assess the performance of an investment or compare its performance to other alternatives. IRRs are commonly used throughout the private equity industry and are made available by most general partners to their investors.

MIRR offers the ability to tailor an IRR to one’s individual situation by incorporating theoretically more realistic rates for the costs of financing investments and the projected reinvestment rate for expected distributions in the future. While less commonly used than IRR in private equity, the MIRR can incorporate assumptions that make it relevant to an investor’s unique situation. Since financing and reinvestment assumptions will differ for each investor and are outside the control of fund managers, funds prefer to use IRR for its more universal application.

Pros and Cons of MIRR

Pros

- Takes into account the time value of money.

- Uses actual reinvestment rates.

Cons

- Requires the additional effort of making realistic assumptions for financing and reinvestment rates.

- More theoretical than practical.

MIRR Formula and Calculation

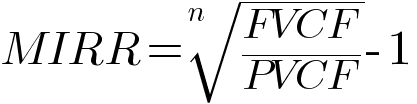

The formula for MIRR is as follows:

where:

FVCF: The future value of positive cash flows discounted at the reinvestment rate.

PVCF: The present value of negative cash flows discounted at the financing rate.

n: Number of periods.

How to calculate MIRR: An example

Assume a series of cash flows for a hypothetical fund as shown below (all values are in $ millions):

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Investments | \-50 | \-40 | \-35 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Distributions | 0 | 0 | 0 | 0 | 0 | 28 | 37 | 37 | 56 | 39 |

Assumptions:

Reinvestment rate for distributions = 4%

Financing rate for investments = 6%

Calculation:

The present value of investment outflows (PVCF) discounted at 6% = -$112.16M

The future value of distribution inflows (FVCF) discounted at 4% = $210.38M

MIRR = 6.5%

MIRR vs. IRR: What’s the difference?

IRR and MIRR address the challenge of determining an effective return on investment where multiple, irregular cash flows are involved. In doing so, they provide investors with a means of comparing such investments to others with different cash flows and to those characterised by a single negative cash flow to start and a single positive cash distribution. This allows investors to compare the returns of private equity funds to other investments, including those available through public equity funds or portfolios.

The calculation of IRR produces a single rate of return for all the cash flows in the specified time period. To do so, however, assumes that the financing rate for inflows and the reinvestment rate for outflows are the same as the rate of return inside the investment.

To the extent that the financing rate, the investment rate, and the reinvestment rate are all the same, IRR will provide an accurate measure of the equivalent return of the cash flows. But generally, those rates are not the same, so MIRR adjusts for the differences in these rates.