Key takeaways

- Trade tensions under the Trump administration are creating uncertainty, potentially causing exit delays in the short-term as companies await clearer market conditions.

- The secondary market is doing well ² ³ precisely because traditional exit pathways are constrained, providing an alternative for investors seeking to cash out of older investments and GPs needing to return capital.

- Pressures on investors to rebalance portfolios, combined with fund managers using continuation funds to retain assets, are fuelling activity and creating potentially more attractive secondaries buying opportunities.

The global macroeconomic and capital markets climate so far this year is characterised by a word few investors relish: uncertainty.

Heightened tensions around the Trump administration’s on-again-off-again tariffs and a seeming stalemate between the US and China are creating consternation. Volatility has rippled through markets, impacting everything from public equity valuations⁴ to private company exit prospects.⁵ Initial public offering (IPO) timelines, once confidently pencilled in, are being reassessed and sometimes postponed as companies wait for calmer waters.⁶ ⁷ Mergers and acquisitions (M&A), particularly cross-border deals potentially affected by trade friction, also face new hurdles. There's a sense that overall exit activity for private equity, which had an encouraging start to the year,⁸ could become subdued if these headwinds persist (although the ongoing trade negotiations as well as Trump's recent conciliatory remarks on the prospects of reaching a deal with China are certainly a positive sign).

Recent exit revival

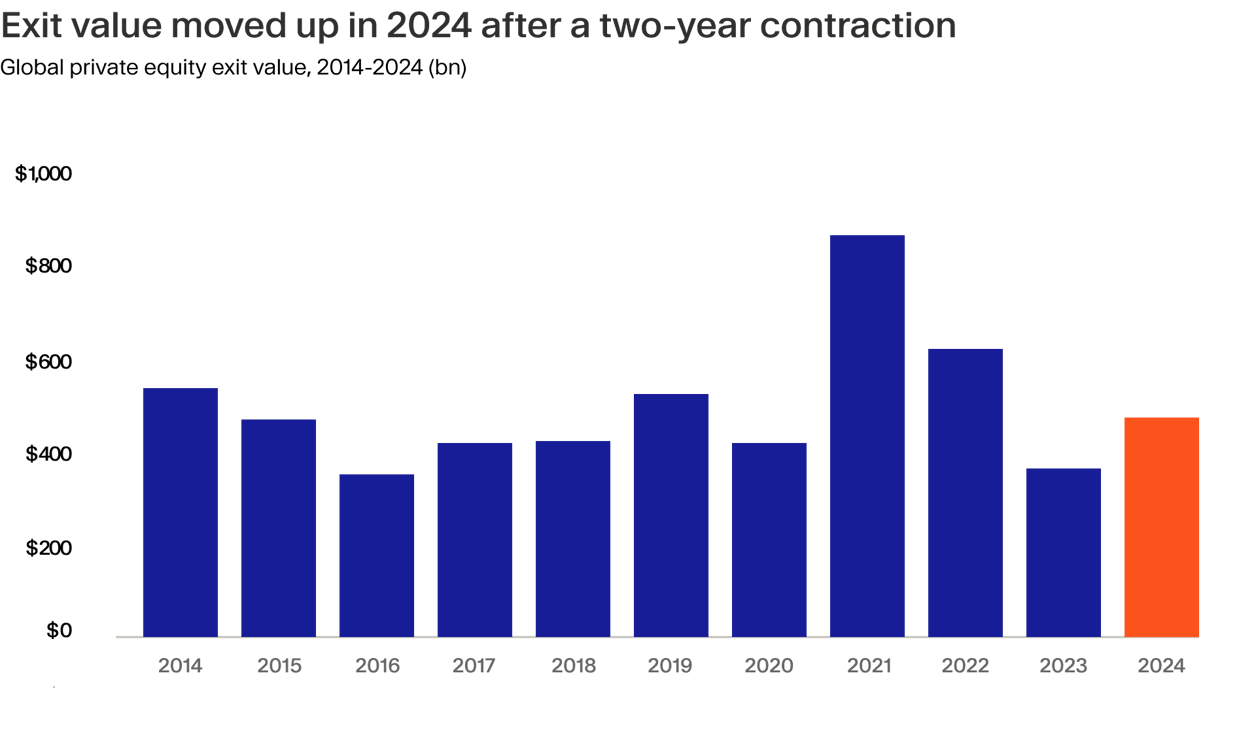

This renewed uncertainty has arrived after a run-up in PE exits. After a sluggish period, 2024 saw a notable rebound. Global exits reversed their two-year contraction, value climbing 34% year-over-year to $468 billion, with the exit count rising 22%, according to Bain & Company. This positive momentum was evident across both North America and Europe.⁹

While value soared, the number of deals actually fell, indicating a concentration in larger transactions, notably including a resurgence in PE-backed IPOs¹⁰ before the latest wave of stock market volatility set in. In the US, for example, seven sponsored public listings were completed for $76.5 billion in the first three months of the year, already besting 2024’s full-year total for value and halfway measured by exit count.¹¹ While this recent strength may provide confidence in the quality of assets held within PE portfolios, the current environment threatens to cut that run short. This is precisely where secondaries come in.

Secondaries are thriving

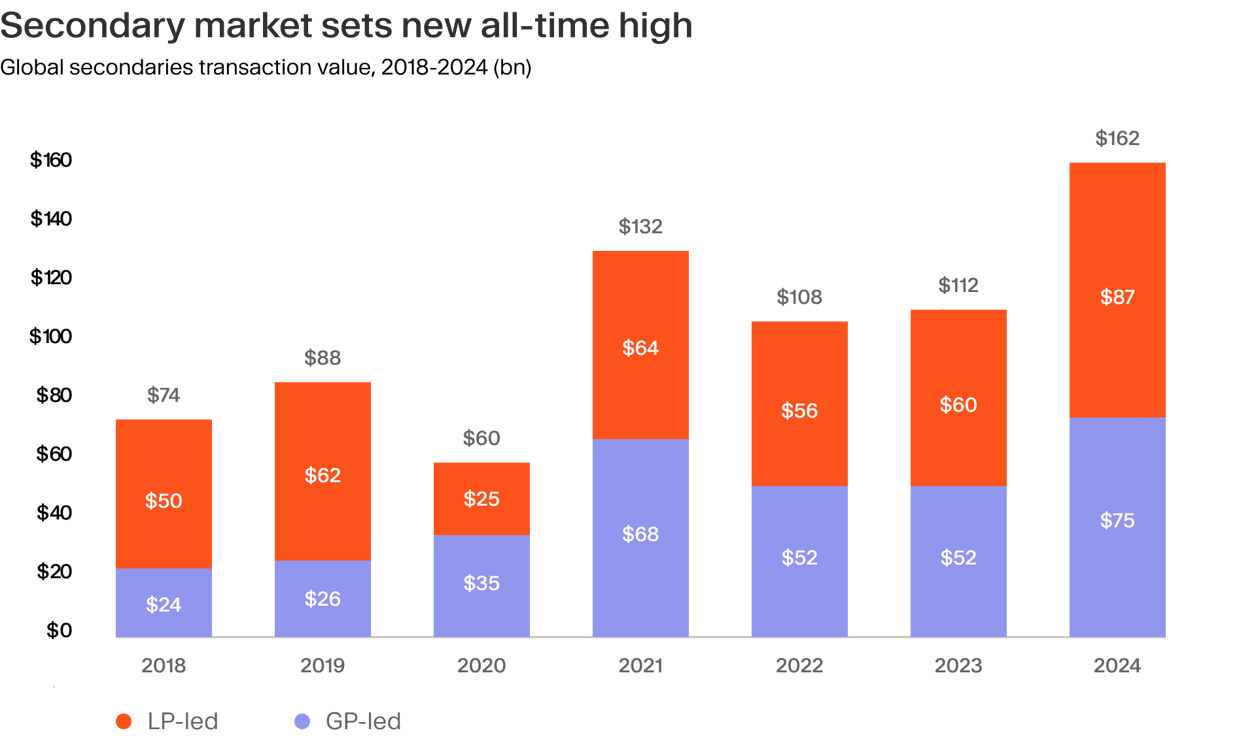

The private equity secondary market, where investors buy and sell existing stakes in funds (LP-leds) or portfolios of direct investments (GP-leds), is thriving. Market reports from advisors consistently point towards record levels of activity over the past 18 months. Last year, somewhere between $152 billion¹² and $162 billion¹³ transacted across both LP-led and GP-led transactions, far surpassing the previous high watermark of $132 billion set in 2021.

That’s because when traditional exit routes are pinched, secondaries can provide essential liquidity for both LPs and the GPs managing funds on their behalf.

Meanwhile, investors are increasingly signalling that they need to see capital returned from existing investments before committing significant amounts to new funds. As McKinsey notes, this pressure for capital distributions is mounting, weighing on the fundraising market.¹⁴A similar sentiment was observed in Moonfare’s recent Investor Survey with 48% of respondents saying that slower distributions affected their ability to reinvest in private markets (Moonfare will publish the full survey results in May).

With IPO markets and M&A running at a slower pace than in recent years,¹⁵ ¹⁶ GPs have been turning more willingly to the secondary market. This has given to the explosive rise of GP-led secondaries in 2024,¹⁷ where a fund manager initiates the sale of one or more assets from an existing fund, with the option for LPs to either sell their positions or roll over into a new continuation vehicle (CV). CVs may offer investors an attractive risk-reward profile. According to a Morgan Stanley analysis of a 2018-2023 fund sample, cited by Adams Street Partners, these vehicles compete with the performance of vintage-matched buyout funds, while benefitting from potentially lower downside risk.¹⁸ This de-risking potential is a function of CVs shorter holding period, investing into more mature assets with clearer performance visibility and, crucially, conservative pricing achieved from buyers typically paying discounts to net asset value (NAV).¹⁹ ²⁰

Overallocations and discounts

Before GP-leds became a measurable segment of the market in the mid-2010s,²¹ secondaries almost exclusively comprised LP-leds. We believe that current public equity market volatility makes these investments equally relevant today, particularly when stocks decline and the relative value of an LP's private equity holdings increase as a percentage of their total portfolio.

This 'denominator effect' can push institutional investors beyond their target allocation ranges for PE. These overallocated LPs may then look to the secondary market to sell down some of their private fund stakes to bring their portfolios back into balance, creating supply. A recent Adams Street survey found that 40% of investors view selling assets into the secondaries market as a top priority,²² the highest reading recorded since the survey’s inception in 2020.

At the same time, volatility can also create opportunities for discerning buyers. While overall LP-led secondary pricing showed tightening discounts through 2024,²³ meaning sellers received prices closer to the reported net asset value (NAV) of their holdings, the current backdrop introduces new complexities.

Persistent market stress, particularly concerns around tariffs impacting global supply chains and company earnings, could lead to an increase in more motivated, or even forced sellers. If this occurs, we might see NAV discounts widen once again. This may create the potential for buyers in the secondary market to acquire relatively high-quality, mature assets at more attractive valuations than might otherwise be available. Secondaries become even more relevant in unpredictable economic and choppy market environments. It is no coincidence that 46% of Moonfare investors²⁴ believe they currently offer the best investment opportunities in private markets, behind only mid-market buyouts. However, we view secondaries not just as a cyclical phenomenon but as an integral part of an increasingly mature and sophisticated PE ecosystem.

Opportunity in uncertainty

No one knows for certain whether the global economy slows from here or whether trade disputes, between the US and China in particular, will be swiftly resolved. Negotiations over tariffs and their potential impact on business earnings and economic growth are all decisive variables with unclear outcomes. However, this very uncertainty reinforces the structural importance of the secondary market. We believe it acts as a vital liquidity valve, allowing GPs to return capital and LPs to manage their portfolios more proactively. For buyers, this presents a unique opportunity to access established private equity investments, while potentially benefitting from attractive pricing dynamics influenced by broader market volatility and sentiment. In an environment demanding caution, like today’s, we think secondaries may present one of the most compelling private markets strategies going.

¹ https://www.lazard.com/research-insights/lazard-2024-secondary-market-report/ ² https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf ³ https://www.lazard.com/research-insights/lazard-2024-secondary-market-report/ ⁴ https://www.reuters.com/business/wall-st-week-ahead-broadening-asset-volatility-intensifies-worries-tariff-tossed-2025-04-11/ ⁵ https://www.wsj.com/articles/tariff-upheaval-threatens-private-equitys-exit-recovery-hopes-cdf16fa2 ⁶ https://www.ft.com/content/ec30d90c-0296-4c73-8e33-16b448c69284 ⁷ https://www.pymnts.com/news/ipo/2025/tech-companies-pause-ipo-plans-amid-investor-uncertainty-from-tariffs/ ⁸ https://pitchbook.com/news/reports/q1-2025-global-pe-first-look ⁹ https://www.bain.com/insights/outlook-is-a-recovery-starting-to-take-shape-global-private-equity-report-2025/ ¹⁰ https://www.axios.com/pro/all-deals/2025/04/02/us-private-equity-exit-values-double ¹¹ https://files.pitchbook.com/website/files/pdf/Q1_2025_US_PE_Breakdown_19009.pdf ¹² https://www.lazard.com/research-insights/lazard-interim-secondary-market-report-2024/ ¹³ https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf ¹⁴ https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report ¹⁵ https://www.spglobal.com/market-intelligence/en/news-insights/research/global-ma-by-the-numbers-2024-in-review ¹⁶ https://stockanalysis.com/ipos/statistics/ ¹⁷ https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf ¹⁸ https://www.adamsstreetpartners.com/insights/2025-global-investor-survey/ ¹⁹ https://www.schroders.com/en-us/us/institutional/insights/the-role-of-continuation-funds-in-a-private-equity-portfolio/ ²⁰ https://www.bain.com/insights/have-secondaries-reached-a-tipping-point-global-private-equity-report-2024/ ²¹ https://www.jefferies.com/wp-content/uploads/sites/4/2025/02/Jefferies-Global-Secondary-Market-Review-January-2025.pdf ²² https://www.adamsstreetpartners.com/insights/2025-global-investor-survey/ ²³ https://www.lazard.com/research-insights/lazard-2024-secondary-market-report/ ²⁴ Moonfare Investor Survey 2025