Key takeaways

- Recent fundraising pressures are prompting consolidation of fund managers operating in the mid- and low-cap markets.

- GP stakes funds are providing necessary capital, as well as operational and market expertise to fuel private equity managers’ growth plans.

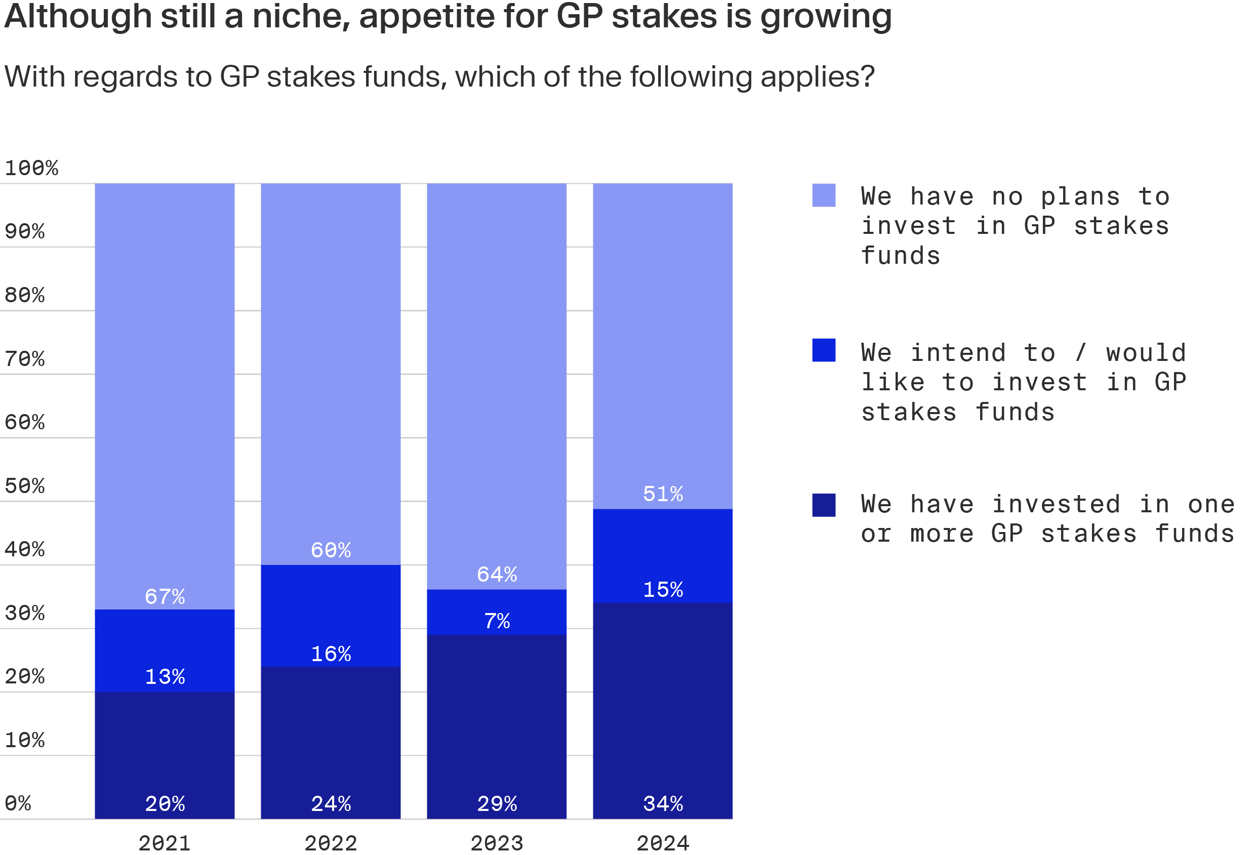

- Limited partners (LPs) are demonstrating growing appetite for GP stakes funds and their unique return profile.

The secular growth of private markets over the past two decades is something to behold and there is little sign of this ascent slowing in the long run. By some estimates, total assets under management (AUM) in private markets are on course to triple to around $30 trillion in the coming years, repeating the already threefold increase in AUM since the global financial crisis.¹

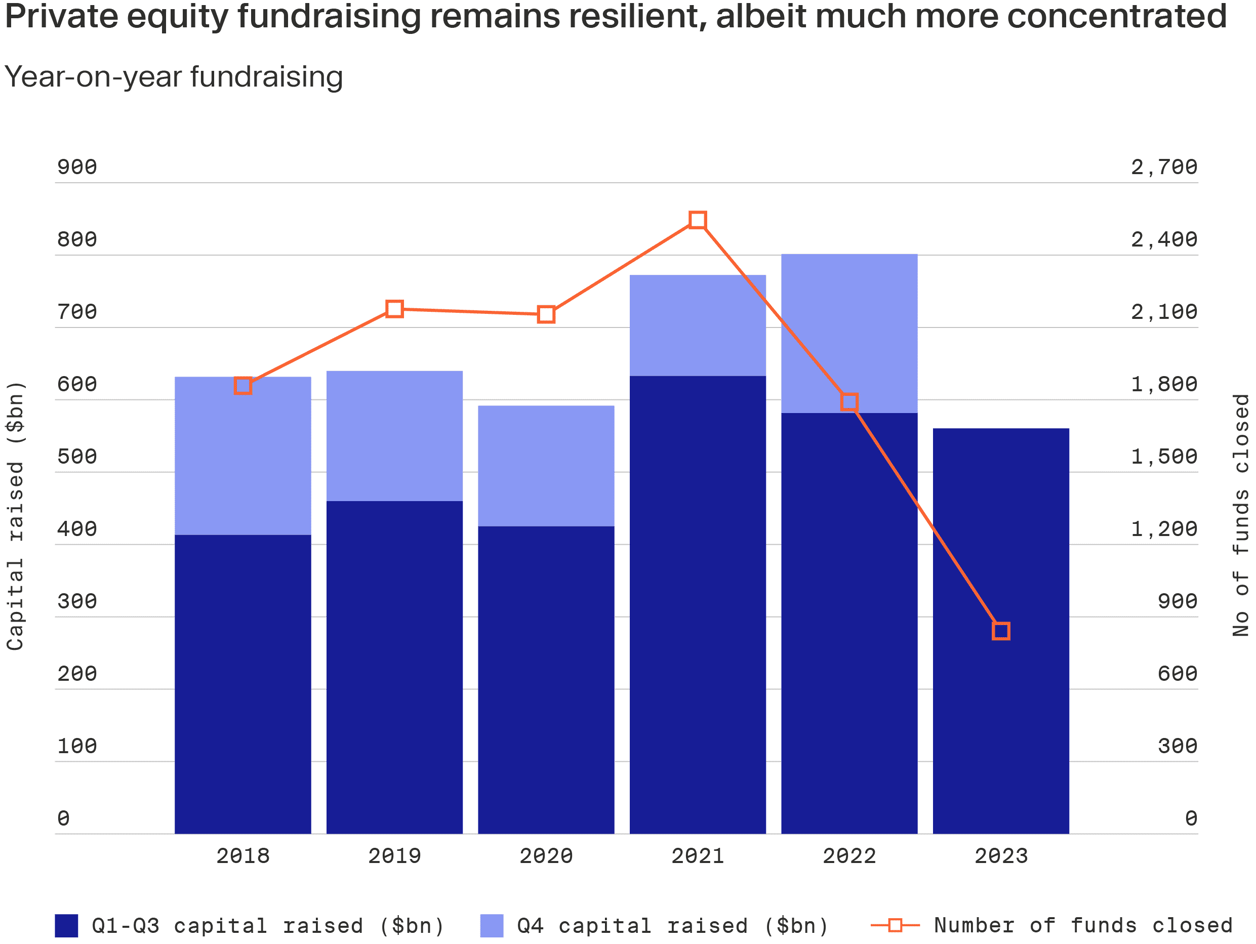

Recently, however, some friction has been building. In the first nine months of 2023, fundraising by private equity firms, which claim the largest share of private markets, fell for a second consecutive year to $561.3 billion, down 4% year-on-year.² A slowdown in exits and therefore distributions has limited investors’ capacity to commit to new funds, suppressing the natural fundraising cycle.

Not all private equity managers are feeling this liquidity pinch. In fact, the average fund has grown in size as capital concentrates in the hands of fewer large-cap managers with lengthy track records, which are often viewed as safe pairs of hands. It is estimated that the mean private equity fund closed in Q1-Q3 2023 was nearly 52% larger than in full-year 2022.³

The dominance of larger players is pressuring smaller fund managers, also known as General Partners (GPs), to adapt or risk obsolescence, priming the industry for a round of consolidation. Given today’s liquidity constraints, new sources of capital are being sought to fund these merger ambitions, support succession transitions and provide for GP commitments to firms’ own funds.

What are GP stakes funds?

GP stakes funds are relieving some of this pressure. These funds make minority investments in private capital firms themselves, the GP, rather than the funds being managed, often targeting mid-cap firms but larger, blue chip names are also viable targets. For instance, Blue Owl Capital, widely considered a pioneer in the space, has invested in the likes of CVC Capital Partners, HIG Capital, Silver Lake Partners and Vista Equity Partners.

GP stakes investing is not new. Dyal, which merged with Owl Rock Capital Group in 2021 to form Blue Owl⁴, started out in 2011 targeting hedge funds in the wake of the global financial crisis. By the mid-2010s private capital managers had come into focus and the strategy has more recently gained notable traction.

In January 2023, Dyal Capital Partners V collected $12.9 billion, the largest haul of its kind so far.⁵ Direct competitors include Goldman Sachs Asset Management’s Petershill fund series and Blackstone’s Strategic Capital Holdings Fund group, which last raised $5 billion and $5.6 billion in 2022 and 2021, respectively.⁶⁷ Other names include Bonaccord Capital Partners, Wafra and Investcorp's Strategic Capital Group, the latter two recently acquiring an interest in UK PE firm MML Capital.⁸

LPs are now embracing GP stakes funds. A recent industry survey found a five percentage point increase in investors saying they have invested in these vehicles compared with the previous year.⁹ The proportion of LPs that are considering such fund investments also doubled to 15% on the year.¹⁰

What investors gain from GP stakes investing

There are several likely reasons for this growing appetite. Investors gain a share of GPs’ management fees, benefitting from a steady stream of income that makes for a stable, yield-like return source and offers downside protection if the firm fails to raise successor funds. Importantly, investors additionally earn a share of the GP’s carried interest on its various funds, capturing potentially sizeable upside. They may also benefit from the appreciation of the invested stake if the private equity firm successfully grows the business. A further benefit is diversification. Similar to a fund of funds, a GP stake vehicle is tantamount to a “fund of firms”. By investing in a spectrum of GPs, investors spread their risk across various managers with exposure to multiple strategies, geographies and vintages with a single fund commitment.

What’s in it for GPs?

For GPs, the sale of a minority stake offers a strategic infusion of capital that ballasts the firm’s balance sheet, providing funding for numerous uses. This can enable the GP to finance growth initiatives, expand into new private asset class strategies, including by funding mergers, and meet day-to-day operational expenses. Such transactions are a much needed liquidity source in the current cash-constrained, low-exit-volume environment and are crucial for funding GP commitments to what are often successively larger funds. But these deals bring more than just capital to the table. As seasoned investors in management firms, GP stakes funds offer vital ancillary advisory support, contributing operational knowhow and strategic insights, while the investee firm ultimately retains its autonomy. This close partnership can help GPs to navigate market challenges, capture growth opportunities and enhance their overall value proposition.

GP stakes versus public PE stocks

The largest private capital managers in the world trade on stock markets. Ares, Blackstone, Brookfield, Carlyle, KKR and many others are freely available to investors. So why choose to invest in an illiquid GP stake fund when there are liquid options? The short answer is far broader exposure and diversification. By investing in multiple managers, a GP stakes fund taps into various different market segments, including the less accessible mid-market space. In contrast, publicly listed PE firms are inherently large-cap focused. The income sources in GP stakes are more diverse, encompassing management fees, carried interest and stake appreciation, offering a multi-dimensional return profile. In the public markets, shareholders typically benefit from potential share price appreciation as the firm grows its fee income and periodic, sometimes annual special dividends funded by carried interest. These public investments in PE firms are also at the mercy of broader market sentiment and volatility.

Weighing risks

No investment comes without risks and this of course applies to GP stakes funds. These mirror the inherent risks of orthodox investing in private capital funds. Namely, these are illiquid in nature – and commensurately deliver compelling risk-adjusted returns that have been shown to reach the mid-teens in mature portfolios.¹¹ They are also exposed to a degree of key-person risk, though to a lesser extent than traditional PE fund investments. The departure of partners or star dealmakers within the GP firm can impact the investment's value. However, given the inherent diversification in these funds across numerous firms, this risk is largely mitigated. Arguably the most common and unique criticism levied at the strategy is the perceived limited exit routes. The counter argument is that, as a relatively young and niche market, there are naturally fewer buyers of these GP stakes today. Even then, there are already examples of successful divestments. Dyal sold six interests in a single transaction to Navigator Global Investments in 2021 and Wafra exited its position in alternative credit manager Oak Hill Advisors the following year.

As the market continues to expand, led by rising interest in the strategy among LPs and ongoing consolidation throughout the asset management industry, there will likely be a growing sample of exit examples to assuage LPs’ concerns over securing returns.

GP stakes well-positioned for future growth

GP stakes funds are playing a critical role for private fund managers today, providing capital needed to compete and fuel their growth ambitions in an industry that is forecast to become many times larger than it is today.¹² For their part, LPs are being potentially rewarded with a unique return profile that complements their broader private capital portfolios. Although it has taken some time for investors to familiarise themselves with the strategy, this is quickly changing.

¹ https://www.privateequityinternational.com/partners-group-private-markets-aum-to-hit-30trn-within-next-cycle ² https://www.privateequityinternational.com/top-15-fundraises-made-up-around-40-of-capital-raising-total-this-year/ ³ https://www.privateequityinternational.com/download-behind-the-q1-q3-fundraising-numbers/ ⁴ https://www.prnewswire.com/news-releases/owl-rock-and-dyal-complete-business-combination-newly-formed-blue-owl-commences-trading-on-nyse-301295990.html ⁵ https://www.privateequitywire.co.uk/blue-owl-closes-dyal-capital-partners-v-129bn ⁶ https://www.blackstone.com/news/press/blackstone-announces-5-6-billion-final-close-of-second-gp-stakes-fund/ ⁷ https://www.gsam.com/content/gsam/uk/en/institutions/about-gsam/news-and-media/2022/Goldman_Sachs_Asset_Management_Completes_5bn_Final_Close_of_Petershill_IV.html ⁸ https://www.privateequityinternational.com/wafra-and-investcorp-buy-gp-stake-in-uk-headquartered-mml-capital/ ⁹ https://www.privateequityinternational.com/seven-lp-opinions-that-matter/ ¹⁰ https://www.privateequityinternational.com/seven-lp-opinions-that-matter/ ¹¹ https://pitchbook.com/blog/what-is-gp-stakes-investing ¹² https://www.privateequityinternational.com/seven-lp-opinions-that-matter/