Last year’s explosion in private market dealmaking brought into sharp relief the growing demand for alternative assets.

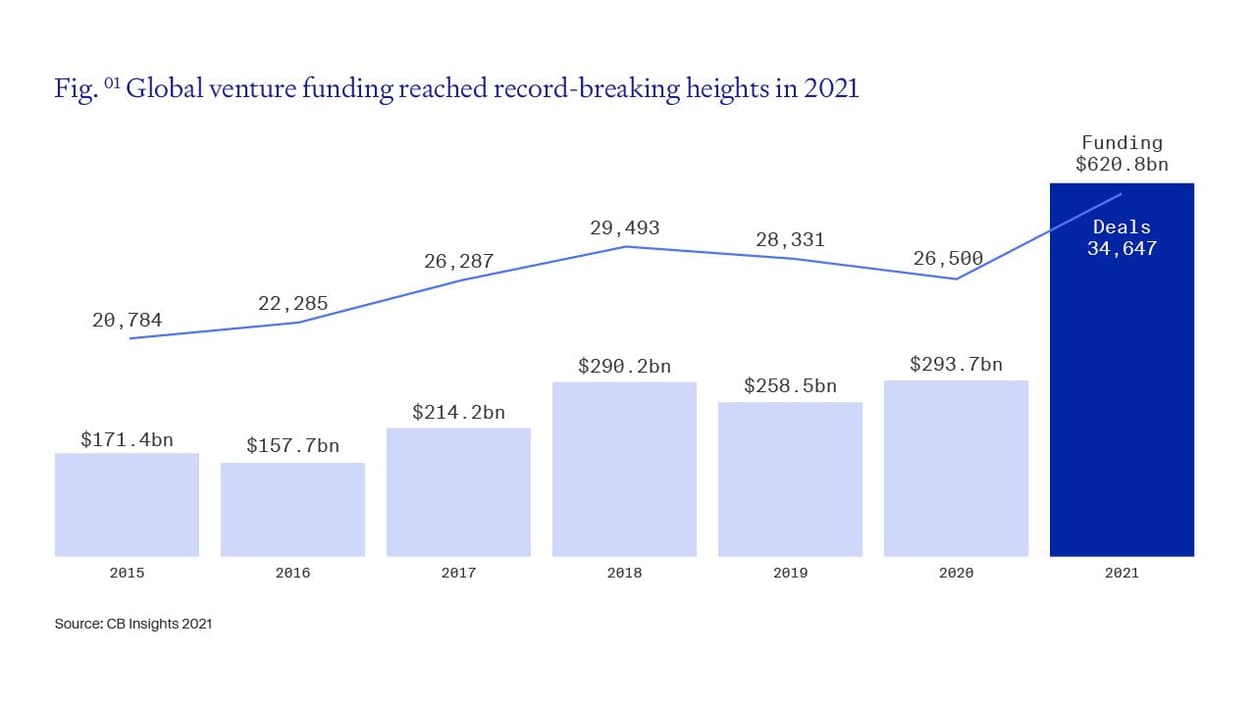

This was particularly true for venture capital (VC), an investment strategy focusing on startups looking to disrupt existing industries, which reached record heights in 2021. VC investors signed nearly 35,000 deals globally last year, at a total clip of more than $620 billion.

To learn more about the outlook for venture capital and what are the benefits of the asset class for investors, download our latest report.

Of course, the cheap money made available to investors during the pandemic-driven central bank monetary easing played a role in this. However, this ignores how attractive the asset class itself has become; and indeed, we are now seeing investors of all kinds gravitating towards VC. From high net-worth individuals to established institutions such as sovereign wealth funds, a broader base of investors is now looking to access fast-growing startups with the ability to disrupt markets, with attractive risk-adjusted returns.

However, the world has changed significantly in the last six months, and the steady macroeconomic and political backdrop that underpinned financial markets in 2021 is no more. Interest rates and inflation are both rising at paces not seen in a generation, while the ongoing conflict in Ukraine has cast a shadow over the future and exacerbated already-stressed supply chains. For VC, this backdrop has led many to question whether recent record-breaking runs in terms of deals, funds and valuations could be over.

In our latest white paper, we make the case for VC in 2022 and beyond. Despite the current rocky environment, the outlook for the asset class is promising, in our view. In particular:

- Private market investment momentum will continue through the year, albeit at a slower pace than 2021’s record-breaking activity.

- Recent valuation resets should allow VC firms to invest in a healthier environment.

- As companies continue to stay private for longer, investors are going to be able to capture a larger share of the profits.