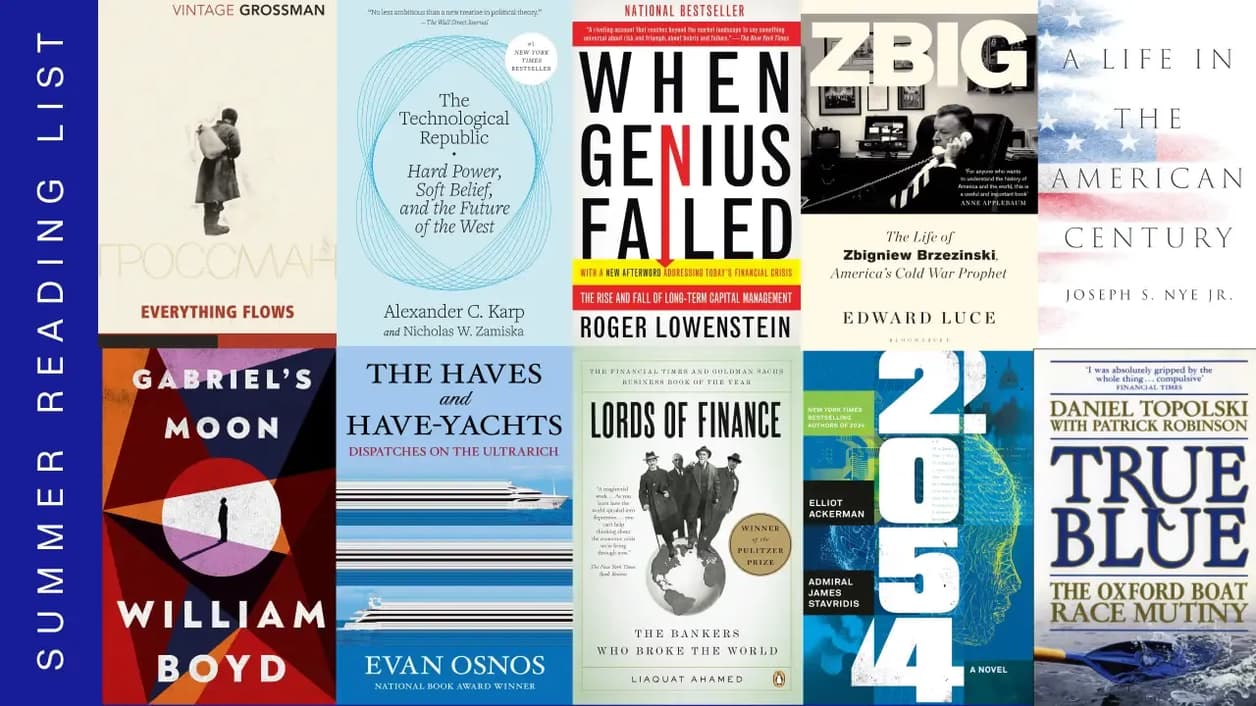

Ofall capital allocated to private equity globally in 2019, 32% was invested into buyout funds. But why might be the reason for it?

Buyout funds represent the most mature, developed segment in private equity, an asset class that has frequently outperformed the public markets in recent decades, and one that is now becoming increasingly accessible to the individuals.

Moreover, buyout funds are the most common form of private equity. They typically invest by taking a controlling stake in privately-held companies, working to improve the operational efficiency and profitability of these businesses, so as to enhance the return on investment when the stake is sold.

These funds will sometimes also take public companies private, and use leverage (borrowing) to acquire larger assets and target excess returns.

Let’s have a look at four main ways that buyout funds create value in their portfolio companies:

1. Step-change the effectiveness of a firm’s management: A team’s leadership usually determines a firm’s performance. Buyout funds work with management teams to increase efficiency in a number of ways:

- Superior governance model: Fund partners will take board seats and often appoint independent senior advisors (frequently ex-CEOs from the industry) to bolster governance and lend expertise.

- Equity incentive to turn managers into owners: Funds will instigate or optimise long-term incentive plans for management teams, and sometimes the wider employee group.

- Talent upgrade: Fund managers will review skill levels and performance at all levels of a business, and identify where changes should be made to ensure the company can maximise execution and innovation.

2. Increase top-line growth and margins through operational support: Buyout fund partners are help portfolio companies develop best-practice processes and systems by focusing on three areas:

- Process and systems improvements: Many funds have a central operations team that can help portfolio companies improve systems from the supply chain to management reporting.

- Revenue growth: With revenue growth being the single largest driver of value creation, funds and their operations teams will focus on supporting portfolio companies to achieve this.

- Global network produces synergies: Buyout funds have access to a global network of resources that portfolio companies can use to their advantage.

3. Access to finance and capital markets: Buyout funds also support portfolio companies through financial expertise,helping them to access credit, invest in inorganic growth (M&A), and make anti-cyclical investments.

Private equity’s access to capital and ability to structure complex transactions involving, for example, different sources of debt give portfolio companies a financial edge over their peer group, something that can be especially important during downturns when access to lifelines and short-term liquidity can make the difference between a firm that goes bankrupt and one that captures additional market share.

4. Multiple expansion: Finally, funds will work to achieve multiple expansion,selling portfolio companies at a higher valuation (expressed as a multiple of enterprise value over EBITDA) than they were acquired.

For more information and source material for the above, please see details here