The environment we find ourselves in today is markedly different to the one we found ourselves in just 18 months ago — in terms of outlook, monetary policy and inflation, among other factors.

While private credit has grown significantly over the past decade, it is this change in wider macroeconomic sentiment that could propel the asset class to become a cornerstone of investor portfolios. In our view, this is down to three key drivers:

Market volatility, bank retrenchment have shrunk traditional capital market access

The increased uncertainty in the last 18 months has significantly impacted traditional lenders. Leveraged loan issuance in Western and Southern Europe, for example, fell by almost 40% in 2022 year on year to €183.4 billion, while high-yield bond activity was down by two thirds over the same period.

In what seems an echo of the aftermath of the global financial crisis, this has created an opportunity for private credit investors to fill this financing gap. However, given the turbulent economic environment, they can now do this on more favourable terms with tighter covenants and other borrower restrictions.

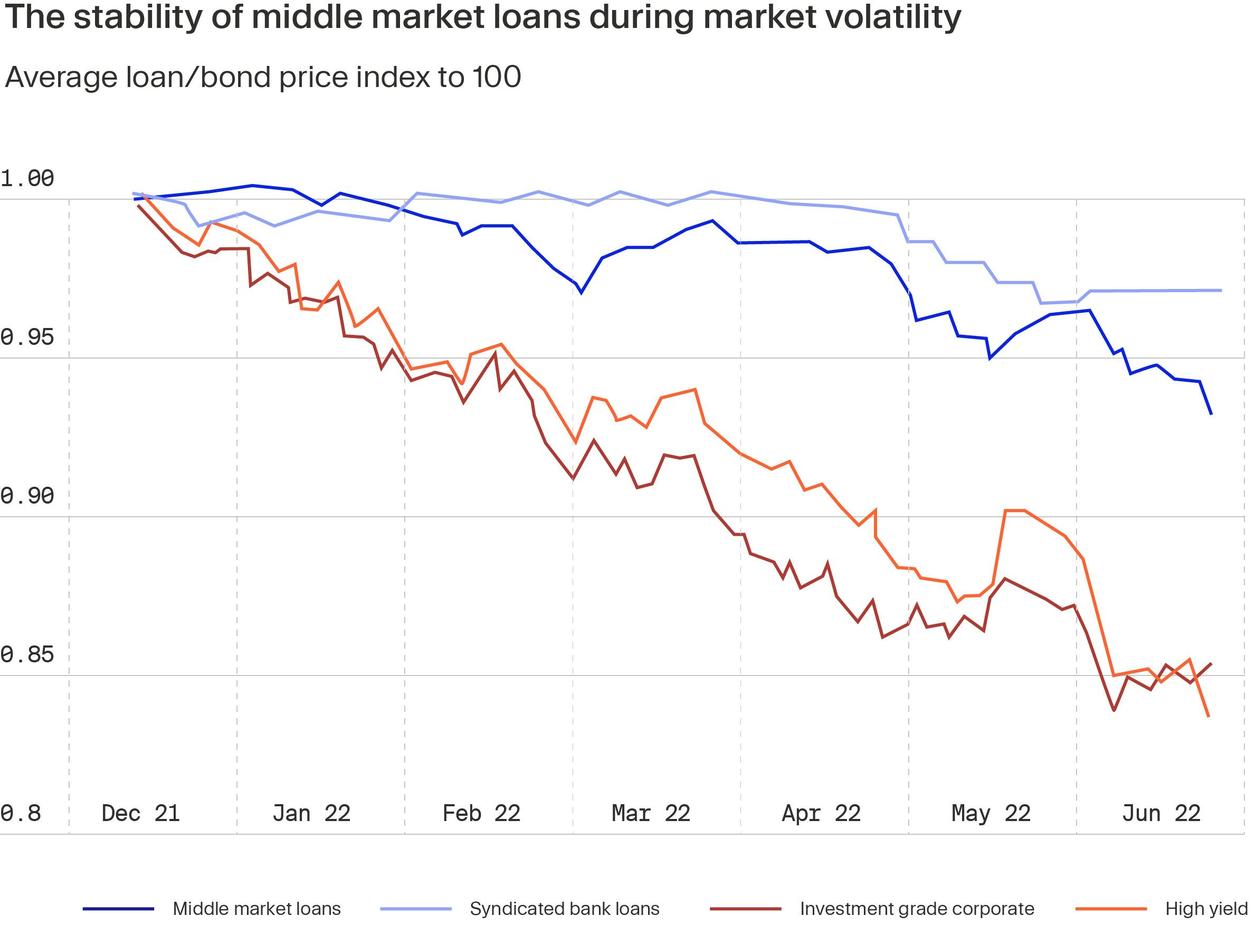

In addition, private market loans have recently shown resilience to market volatility relative to public equivalents, as seen from the graph below. This is in part the case because loans are also not publicly traded and are typically valued quarterly against the fundamentals of the underlying asset. This means they are not subject to the technical market moves experienced by investments with daily mark-to-market pricing such as bonds.

The turbulence may also boost the asset class in another way — with uncertainty leading to lower valuations and more businesses unwilling to sell for less, private credit could become one of the few options left for firms looking for capital.

Rising rates grant credit investors more attractive yield prospects

Many private credit deals are typically structured on a floating rate basis, meaning that the interest rate attached to the financing adjusts relative to a set benchmark rate. These benchmark rates, such as LIBOR, are reference rates neither party can influence. For example, a floating rate note with a margin of 5%, and tied to LIBOR which is trading at 3%, can be said to have a floating rate of 8%.

These rates have increased markedly in the last year as central banks tighten monetary policy. According to PitchBook, floating rates for loans on leveraged buyouts in the US almost doubled from February to September last year, from 4.8% to 9.8%. While this makes financing for the borrower more expensive, for the investor, this becomes an attractive opportunity to generate income at a higher yield. For example, income based returns across private credit reached 6.2% in 3Q 2022, which is higher than high yield bonds which recorded 4.2%. As a result of these forces, income generation has become the key consideration driving private markets investments in 2023, according to the Blackrock survey.

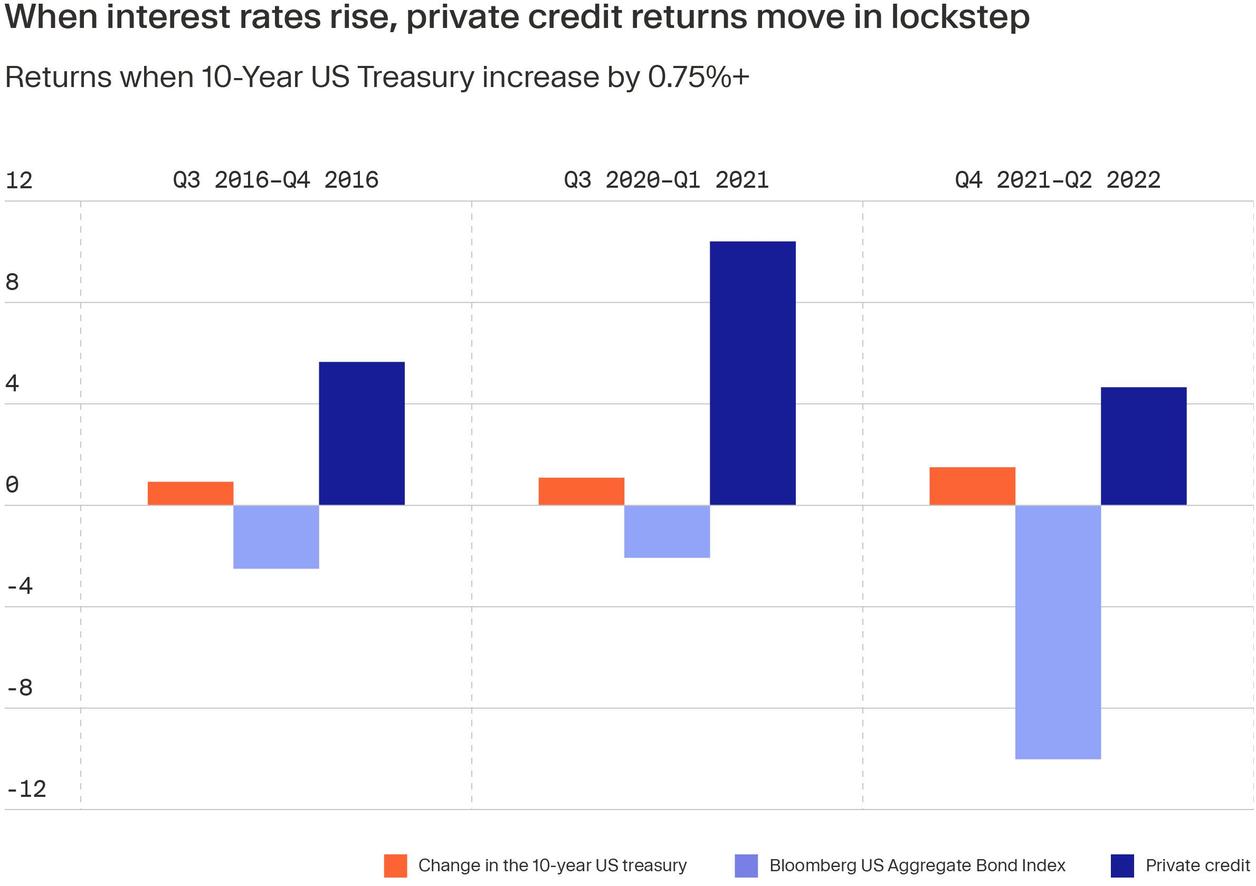

This contrasts the problem public fixed income faces in this rising rate environment, with their value typically sliding as interest rates rise. Indeed, according to Blackstone, private credit significantly outperformed the Bloomberg US Aggregate Bond Index in periods when the 10-year US Treasury rate increased by 0.75%.

Growing demand for refinancing means more opportunities

Private credit is also well positioned to offer both private equity investors and companies an avenue to refinance existing obligations.

For sponsors, higher rates and lower growth is delaying potential exit paths, meaning that some private equity investors may prefer to refinance existing portfolio companies rather than sell them into a down market. For example, CVC Credit announced in May that it had supported the refinancing of KKR-backed cybersecurity company Optiv. This came more than a year after KKR was reportedly exploring a sale or IPO of the business at a valuation of more than $3 billion.

As recessionary forces strengthen and companies face potential defaults, we are also seeing growing opportunities in the distressed debt space. Managers who focus on these types of deals typically get involved in restructuring situations, rescue finance or by purchasing discounted loans. Crescent Capital and Atalaya, for example, both closed their eighth flagship special situation funds at $8.0 billion and $1.8 billion, respectively.