Sustainable investing offers outperforming returns and market resilience while looking after the well-being of people and the planet.

Investors globally are using their economic clout to address the most pressing challenges of our time: climate change, plastic pollution and social injustices.

Read Moonfare’s report on sustainable investing here.

The demand for companies that operate within a sustainability framework - also known as the Environmental, Social, Governance (ESG) principles - has skyrocketed in the last decade.

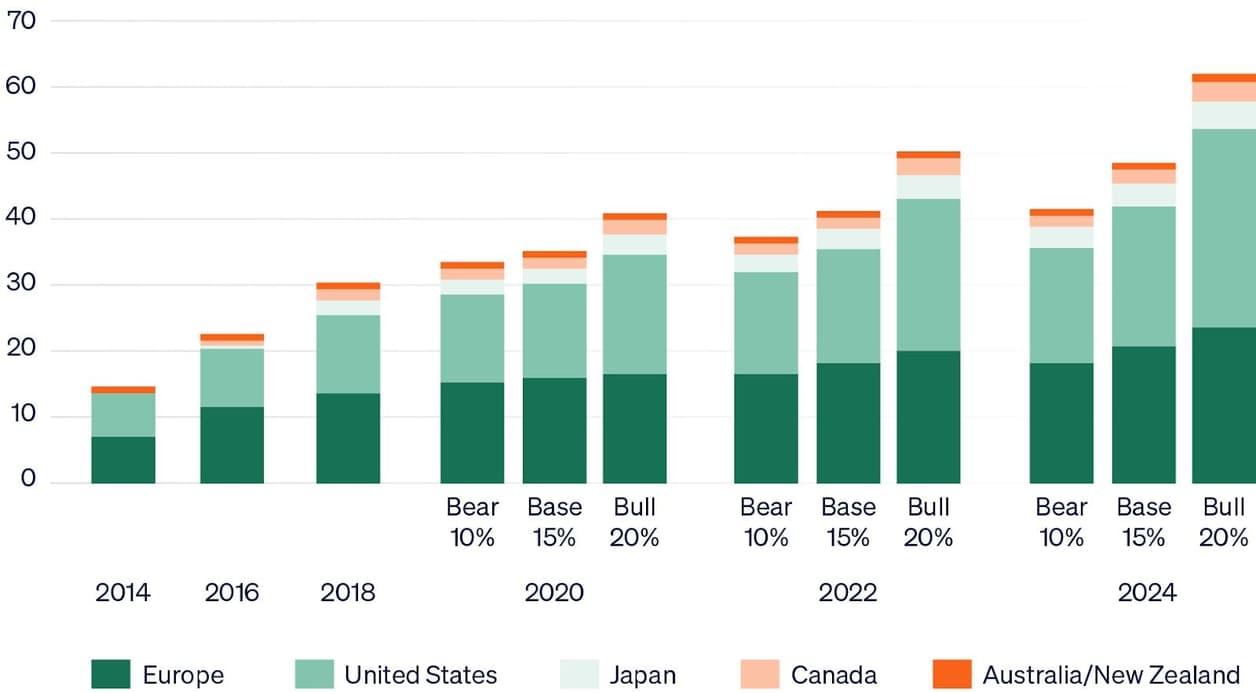

ESG assets globally are on track to surpass $53 trillion by 2025, which represents more than a third of the $140.5 trillion in projected total assets under management. This is up 40 percent from the $37.8 trillion in 2021 and a 130 percent jump compared to 2016, according to Bloomberg analysis.

Source: GSIA, Bloomberg Intelligence

ESG high on the agenda for private equity

The stakes for investors and fund managers are evidently high, matched only by the enthusiasm of the broader financial industry.

To illustrate, the number of signatories to the United Nations’ Principles for Responsible Investment (PRI) network surged 35 percent in 2020 and now number more than 4,400 investors and asset managers. Together, these firms manage a staggering $120 trillion of assets.

ESG policies are now regularly on executive board agendas and many asset owners say they actively integrate ESG considerations into their decision-making or will do so soon.

The major appeal of sustainable investing is the notion that investing in the greater good doesn’t mean sacrificing higher returns. In fact, research consistently shows that sustainability themes generate excellent investment opportunities. They outperform “traditional” strategies across markets and to fare better in market downturns, providing a source of resilience against future market shocks.

Sustainable investing is especially compelling for private equity (PE). Every fourth PE firm already has a thematic sustainable fund in place. Many fund managers are embracing ESG principles not only as a risk mitigation mechanism but also as a potent driver of value creation, with the capacity to generate a substantial premium at the exit. Studies show that sustainable companies are, on average, simply more attractive.

Against this buoyant backdrop, we published a paper that explores the foundations of sustainable investing and the opportunities it offers to investors, particularly in private markets. The paper focuses on three themes:

- Growth drivers - more than just a fad

- Private equity’s big bet on sustainability

- What’s in it for the investors