![[VIDEO] Unpacking the opportunities and growth drivers in private credit](/cdn-cgi/image/width=1256,quality=75,format=auto/https://publiccdn-production.moonfare.com/strapi/production/mw_blogs_bd9fed5aa7_93d734c43e.webp)

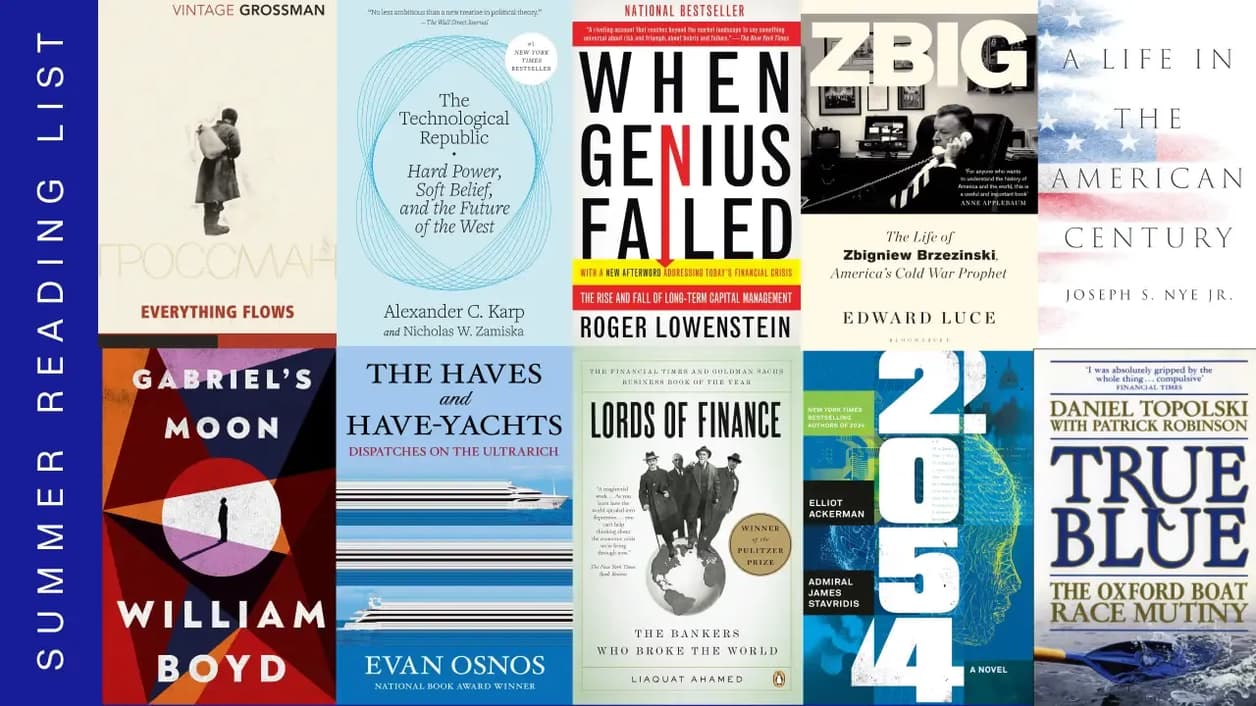

What can private credit offer to investors and is the current economy a good place to get into the asset class?

Watch Taj Sidhu, Managing Director - Partner at Carlyle and the head of the firm's European and Asian Private Credit, as he unravels the unique benefits and sources of resilience that sets private credit apart from more conventional fixed-income investments.

Key takeaways from the conversation include:

The origins of private credit: The evolution of private credit can be traced back to the financial crisis of 2008/09. Regulatory changes ensuing from the financial fallout made it tougher for banks to grant loans to corporations or smaller businesses. Private credit providers swiftly stepped in to bridge the financing gap.

The drivers of private credit outperformance: The advantage that private credit holds over more traditional fixed-income investments largely stems from better alignment between managers in private credit and borrowers. The latter can take advantage of tailored solutions, while lenders can negotiate robust covenants that offer better protection to investors in case of potential defaults.

Private credit in 2023: Many private credit instruments are floating rate, meaning they can thrive in a high-interest-rate environment. Yet, even in periods when rates were lower, private credit strategies have consistently shown a clear return premium compared to fixed income markets.

Managing downside risk: When circumstances become unfavorable, the structure of covenants and open dialogue with borrowers become vital. The success of fund managers in private credit hinges on resources, industry expertise and access to third parties and their resources. These elements can add value and serve as points of differentiation between fund managers.