Due to securities law restrictions and high investment minimums, investors in private equity funds fall into two groups; institutional investors and high-net-worth individuals.

The main institutional players are pension funds, endowment funds and sovereign wealth/national reserve funds. All three are looking to maximise long-term returns – albeit for slightly different reasons – and all three are increasing their private equity allocations.

Pension funds have a singular goal: to fund the pension payments promised to employees when they retire. The long horizon of this goal and the steady stream of new employees requires pension funds to seek predictable returns and gives them the ability to take a long-term view on investing. As a result, pension funds usually have an allocation to private equity, which averages around 9% overall today¹.

An endowment fund is a pool of capital established by a foundation, typically held by a non-profit organisation such as a university, charity or hospital. The organisation makes consistent withdrawals for a particular purpose and the fund is often designed to continue indefinitely.

One well-known example is the Yale University endowment fund, previously run by the late David Swenson and long-considered as a benchmark for strong returns and astute asset allocation. When Swenson took over in 1985, the fund had about 80% allocation to US equities and bonds, with zero private equity. Today, the fund targets a 41% allocation to venture capital and leveraged buyouts, with US equities, bonds, and cash making up less than 10%².

State-owned investment funds represent an enormous pool of capital, often held by a central bank, giving it significant economic importance. Since the goal of the ruling authority is the ongoing running of a country, the time horizon for investments is again very long.

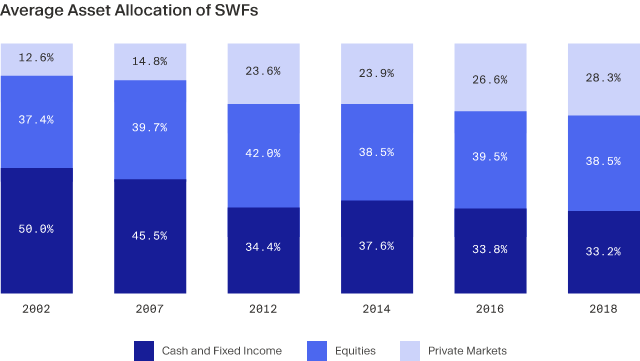

The allocation of sovereign wealth funds to private equity is not only considerable, but it is also growing. Recent research aggregating the 35 largest SWFs found that allocation to private equity grew from 12.6% to more than 28.3% in the last two decades³.

Even with the high minimums typically required to invest in private equity, there are some individuals - or families - that can afford it. They make up a fraction of the total assets under management in private equity, but they have still found access through traditional means for decades.

Ultra-High-Net-Worth individuals are those with investable assets over $30 million, and there are just under 300,000 such people around the world⁴. Much of this wealth is controlled by management firms called “family offices”, so here we will consider them as a single group.

In a Goldman Sachs survey of family offices, there was an average asset allocation of 24% to private equity⁵. KKR research found similar results, with 27% of respondent’s portfolio in private equity⁶. Both surveys noted that the allocation to private equity is likely to increase.

Until recently, the high investment minimums required to tap into private equity had been an impenetrable barrier to entry for individual investors. This was the case even for many high-net-worth Individuals (the estimated 13 million individuals globally worth over $1 million⁷) since minimums have historically been in the millions or tens of millions.

Now, through Moonfare, it is possible to access the private equity market with as little as €50,000. Moonfare aggregates individual demand into feeder fund structures, which then invest directly into the underlying target funds. Moonfare also facilitates a secondary market to provide limited liquidity (though not guaranteed) for its investors.

Important notice: This content is for informational purposes only. Moonfare does not provide investment advice. You should not construe any information or other material provided as legal, tax, investment, financial, or other advice. If you are unsure about anything, you should seek financial advice from an authorised advisor. Past performance is not a reliable guide to future returns. Don’t invest unless you’re prepared to lose all the money you invest. Private equity is a high-risk investment and you are unlikely to be protected if something goes wrong. Subject to eligibility. Please see https://www.moonfare.com/disclaimers.

¹ American Investment Council (AIC) 2021 Pension Report https://www.investmentcouncil.org/wp-content/uploads/2021_pension_report.pdf

² David F. Swensen, “Investment Philosophy,” 1985. See http://investments.yale.edu/about-the-yio. For the current asset allocation, see https://news.yale.edu/2020/09/24/investment-return-68-brings-yale-endowment-value-312-billion

³ State Street Global Advisors “How Do Sovereign Wealth Funds Invest? Less and Less Contrarian” January 2020 https://www.ssga.com/library-content/pdfs/official-institutions-/how-do-sovereign-wealth-funds-invest.pdf

⁴ https://go.wealthx.com/world-ultra-wealth-report-2021

⁵ https://www.goldmansachs.com/insights/pages/ widening-the-aperture-family-office-investments-insights-f/report.pdf

⁶ https://www.kkr.com/global-perspectives/publications/wisdom-compounding-capital

⁷ https://e.issuu.com/embed.html?u=newworldwealth&d=gwmr_2020