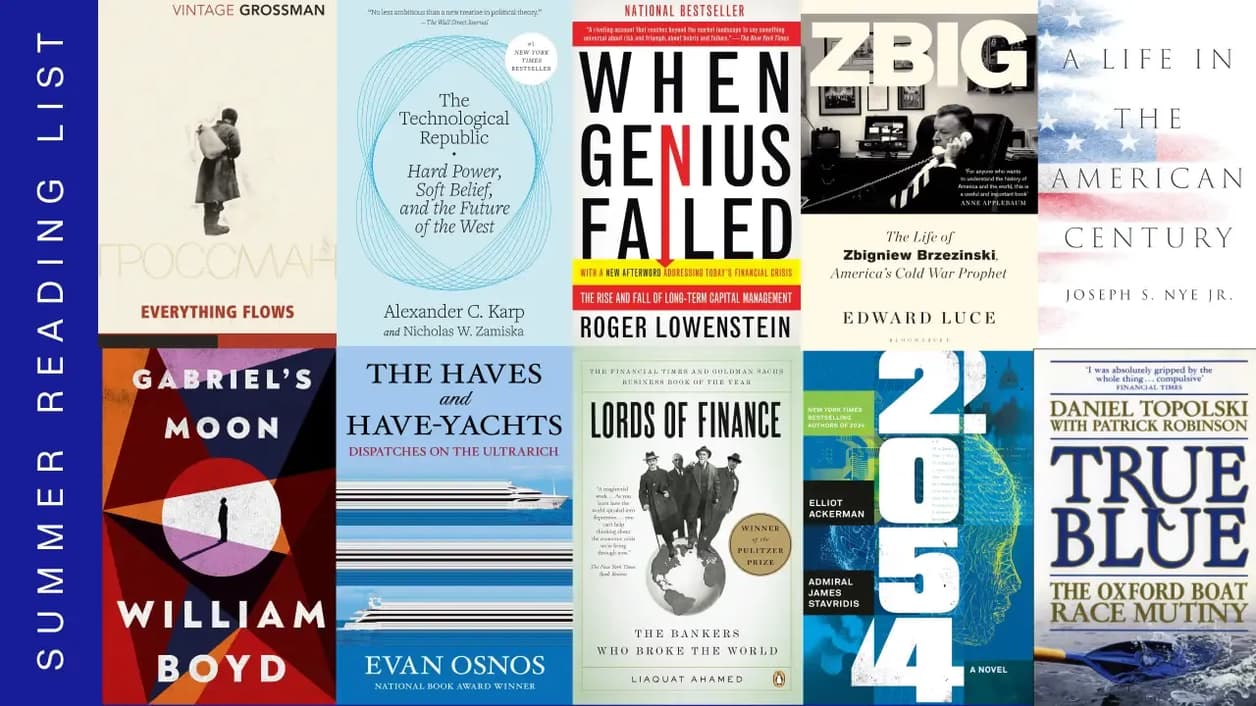

Moonfare’s Chief Economist, Mike O’Sullivan, is travelling the world to bring you insights into each country’s unique economic landscape. His analysis covers macroeconomic trends, local market dynamics and implications for private investors.

Follow Mike right here on the Moonfare blog or through our LinkedIn account as he explores financial hubs around the world. Read also his previous note from Ireland.

Zurich, 24.10.2024

Macro environment

Switzerland is really an outlier. In a world of geopolitical chaos and, in parts, macro weakness, it is the outlier in terms of the stability and adaptability of its economy. Growth is healthy though below average, and lower inflation has permitted the SNB to cut rates.

The Swiss franc is the only currency to hold its value through the long term, but recent strength has raised the issue of the competitiveness of Swiss industry. In the past, it has adapted well.

Economist’s observations

Zurich is a highly cosmopolitan city and compared to other countries one of the key successes of the Swiss model is the way it integrates newcomers to the country, and for example guides them through the apprenticeship system.

The banking community in Zurich is still seeing fallout from the collapse of Credit Suisse — assets and bankers have dispersed across other banks as the ecosystem adapts.

Private markets in Switzerland

Zurich, and Switzerland broadly, is one of the most developed financial centres and there is a broad appetite for private assets — and plenty of discussion on the best asset allocation structure. One topic that also arose is how to scale firms further once they get to the Series B stage.