White Papers

Despite the downturn, 83 percent of PE investors are planning new allocations: Moonfare 2022 Investor Survey

Retail investors in PE are aware that economic challenges lay in the near future. However, they remain bullish on the asset class and are even considering increasing their allocations.

Written by Blazej Kupec

November 28, 2022

Retail investors in private equity are aware that economic challenges lay in the near future. However, they remain bullish on the asset class and even consider increasing their allocations.

This is one of the key findings of the annual Moonfare Investor Survey, conducted in September 2022. With the survey, we wanted to better understand how the investors feel about the state of private equity, given the current economic volatility and overall uncertainty. We are grateful to the 244 members of our community who offered us their views and observations.

Key highlights include:

- Many investors have dwindling confidence in the economic outlook: 73 percent of survey respondents say they feel “somewhat bad” about the current state of the economy.

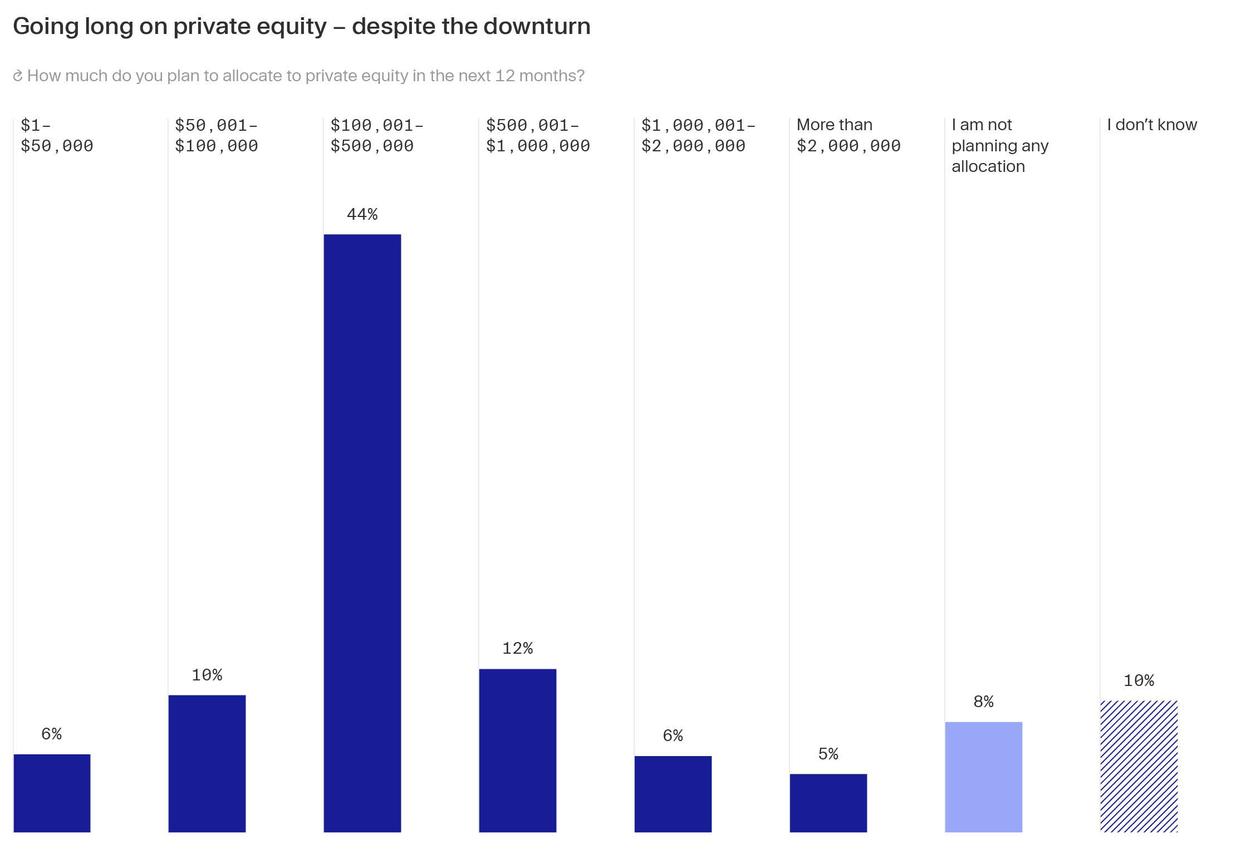

- Investors are doubling down on private equity, despite the macro headwinds: 83 percent are considering making new allocations to the asset class in the next 12 months.

- Buyout funds are seen as the best bets, while defensive strategies gain traction: 56 percent of respondents expect buyouts to generate the best returns in the short term.

- The door to private equity is open, but barriers still exist: When asked about what prevents them from making higher allocations to private equity, 48 percent ranked illiquidity as one of the biggest hurdles, followed by fees (41 percent).

Nota importante: Questo contenuto è fornito a scopo informativo. Moonfare non fornisce consulenza sugli investimenti. Non dovresti interpretare alcuna informazione o altro materiale fornito come consulenza legale, fiscale, di investimento, finanziaria o altro. Se hai dei dubbi, dovresti cercare consulenza finanziaria da un consulente autorizzato. Le prestazioni passate non sono una guida affidabile per i rendimenti futuri. Non investire a meno che tu non sia disposto a perdere tutto il denaro che investi. Si tratta di un investimento ad alto rischio e è improbabile che tu sia protetto se qualcosa va storto. Soggetto a idoneità. Si prega di consultare https://www.moonfare.com/disclaimers.

Authors

Senior Content Manager

Blazej Kupec

Blazej is a senior content manager at Moonfare. With ten years of experience in financial media, he now covers trends and developments in private equity. Blazej especially enjoys creating content that helps people better understand the intricacies of the asset class. He holds a BSc in Political Science from the University of Ljubljana.

Join Moonfare Now.

Benefit from what institutional investors already know: the greatest shareholder value comes from private markets, and funds like those offered on Moonfare have generated an average IRR of 19% — outperforming the S&P 500 by 13%.*

Join The Satellite.

Weekly updates on Investment and Finance.

Subscribe Now